How To Estimate Your Net Worth - A Personal Guide

Figuring out where you stand financially can feel like a big puzzle, but it's actually a pretty straightforward idea once you get going. It's about getting a clear picture of your money situation, sort of like taking a snapshot of everything you own and everything you owe at a single moment. This snapshot, often called your net worth, gives you a simple number that shows your financial health.

A lot of folks wonder how to even begin with this kind of thing, you know, how to estimate your net worth without it feeling like a chore. The good news is that it doesn't have to be perfect right away; it's more about getting a good approximation, a general idea, rather than an exact, penny-by-penny total. Think of it as making an educated guess, a careful calculation of sorts, about your overall financial standing.

This process of making an approximation, or guessing a value, quantity, or even a time frame, is what we mean when we talk about figuring things out, as in to estimate. For instance, you might estimate how long it takes to get somewhere, or how much a repair might cost. Here, we're applying that same thought process to your money, giving you a number you can use to see where you are and, frankly, where you might want to go next with your finances.

Table of Contents

- What is Net Worth, anyway?

- Why Bother Figuring Out Your Net Worth?

- How Do You Actually Calculate Net Worth?

- What Kinds of Things Count as Assets?

- What Counts as Debt, Really?

- Are There Different Ways to Figure Out Your Net Worth?

- What Should You Do With This Number?

- How Often Should You Check Your Net Worth?

What is Net Worth, anyway?

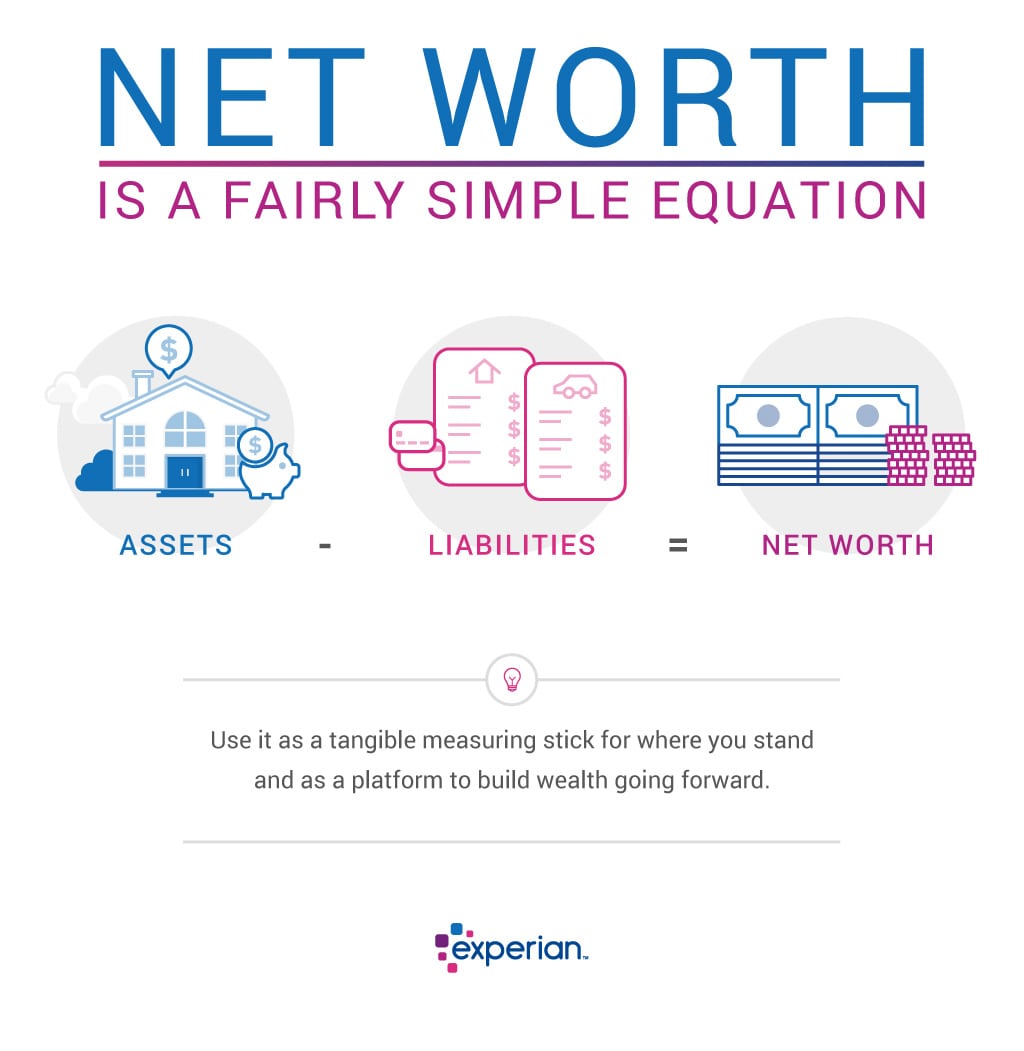

Your net worth is, simply put, what you own minus what you owe. It’s a very basic math problem, really. You add up all your possessions that have a monetary value, and then you take away all your outstanding bills and loans. The number you're left with is your net worth. It's a way of, you know, measuring your financial standing at a particular point in time.

This figure gives you a general idea of your financial position. It's not about how much cash you have in your pocket right now, but more about the total value of your financial life. So, it includes things that might not be liquid, like your house or your car, as well as the money you have in savings. It's a broad overview, you could say.

Some people might find the idea of putting a number on their financial life a little bit unsettling, but it's just a tool. It's a way to get a good estimate, a close guess, of where you are. This number can be positive, if you own more than you owe, or it could be negative, if your debts are larger than your assets. Both are normal places to be at different times in life, by the way.

Getting a Handle on Your Financial Standing - how to estimate your net worth

Getting a handle on your financial standing means taking a moment to gather up all the pieces of your money picture. It’s about collecting the information you need to make that calculation. You’re essentially preparing to make a careful guess, a kind of financial approximation, of your overall situation. This initial step is, in some respects, the most important one.

This isn't about judging yourself or feeling bad about numbers. It's just about getting the facts down. Think of it like taking inventory of your belongings before a big move. You need to know what you have before you can figure out what to do with it. So, figuring out how to estimate your net worth really starts with this information gathering.

It's a way to be honest with yourself about your money, which is, frankly, a very healthy thing to do. Knowing where you stand allows you to make better choices about spending, saving, and investing in the future. It's a starting point, nothing more and nothing less.

Why Bother Figuring Out Your Net Worth?

You might wonder why anyone would want to go through the trouble of figuring out this number. Well, it's actually quite useful. Knowing your net worth gives you a baseline, a starting point from which to measure your financial progress over time. It's like checking your weight when you're trying to get healthier; you need to know where you are to see if your efforts are making a difference, you know?

It helps you see the bigger picture beyond just your monthly income and expenses. Sometimes, we get so caught up in the day-to-day money stuff that we lose sight of our overall financial health. This number can help you spot trends, whether good or bad, that you might not notice otherwise. So, it's a bit like having a financial compass.

For example, if your net worth is slowly but surely going up, that's a pretty good sign that your money habits are working for you. On the other hand, if it's going down, it might be a signal to take a closer look at where your money is going and make some adjustments. It's a simple indicator, but a powerful one, actually.

The Value of Knowing - how to estimate your net worth

The value of knowing your net worth is tied to making smart choices. When you have this figure, you can set financial goals that are realistic and measurable. Maybe you want to save for a house, or plan for retirement, or just build up a bigger emergency fund. Knowing your current standing helps you figure out how much ground you need to cover.

It also helps you understand the effect of your decisions. If you take on a big loan, you'll see how that affects your net worth. If you pay down debt or make a good investment, you'll see that reflected too. It’s a way to get a good estimate, a close idea, of the impact your financial actions have. This feedback is, frankly, pretty important.

Ultimately, it gives you a sense of control and direction over your money. It moves you from just reacting to financial situations to actively planning for your future. This kind of information is, basically, empowering. It helps you understand the full scope of how to estimate your net worth and why it matters.

How Do You Actually Calculate Net Worth?

The calculation itself is pretty simple. It's a matter of listing out everything you own that has value, then listing out everything you owe. Once you have those two lists, you subtract the total of what you owe from the total of what you own. The result is your net worth. It’s like a balance sheet for your personal finances, you know.

You don't need fancy software or a finance degree to do this. A simple spreadsheet or even a piece of paper and a calculator will do the trick. The most important part is being honest and thorough with your lists. You're trying to get a solid approximation, a pretty good guess, of your financial situation, so accuracy helps.

Remember, this is about getting a general idea, not necessarily a precise, moment-by-moment valuation of every single item. So, for instance, you don't need to get an appraisal for every piece of furniture you own. A reasonable guess will often be just fine for many things, especially when you are learning how to estimate your net worth for the first time.

Gathering Your Financial Pieces - how to estimate your net worth

To gather your financial pieces, you'll want to pull together statements from all your bank accounts, investment accounts, retirement funds, and any property you own. You'll also need statements for all your loans, like mortgages, car loans, student loans, and credit card balances. It's a bit like collecting all the ingredients before you start cooking, you see.

For things like your home or car, you can use online tools to get a rough idea of their current market value. Websites that show recent sales in your area for homes, or pricing guides for cars, can give you a pretty good estimate. You're just looking for a close approximation, not a perfect figure, for these larger items, as a matter of fact.

Make sure you don't forget smaller assets, like any cash you keep at home, or perhaps valuable collections. And certainly don't overlook any debts, even small ones. Every little bit counts when you're trying to figure out how to estimate your net worth accurately enough to be useful.

What Kinds of Things Count as Assets?

Assets are basically anything you own that has monetary value. This includes cash in your checking and savings accounts, money in investment accounts like stocks, bonds, or mutual funds, and funds in retirement accounts such as a 401(k) or IRA. These are all pretty clear-cut examples, as you can see.

Your home, if you own it, is typically your biggest asset. The same goes for any other real estate you might own, like a rental property. Vehicles, like cars, motorcycles, or boats, also count. Even valuable personal items, such as jewelry, art, or antiques, can be considered assets, especially if they have a significant resale value, you know.

Don't forget things like money owed to you, or the cash value of a life insurance policy, if it has one. Even certain business interests or intellectual property could be assets. It's about taking a broad view of everything that could be converted into money, or represents a store of value, when you are figuring out how to estimate your net worth.

Adding Up What You Own - how to estimate your net worth

Adding up what you own means making a list and putting a current value next to each item. For bank accounts, it's just the balance. For investments, it's the current market value. For your home, as I was saying, use a reasonable guess based on recent sales in your area. You're trying to get a solid approximation for each item.

It's okay if some of these numbers are a bit of a guess, especially for things that don't have a clear daily market price. The goal is to get a pretty good estimate of the total. Don't spend hours trying to figure out the exact value of every single possession. A good, common-sense guess is often sufficient, you know.

Once you have all your assets listed with their estimated values, simply add them all up. This total will be the "what you own" part of your net worth calculation. It's a big step in learning how to estimate your net worth effectively, as a matter of fact.

What Counts as Debt, Really?

Debt is, simply put, money you owe to others. This includes your mortgage, which is usually the biggest debt for homeowners. It also covers car loans, student loans, and any personal loans you might have taken out. These are pretty common forms of debt, as you can imagine.

Credit card balances are a very common type of debt. Even if you pay off your cards in full each month, the balance on the day you calculate your net worth still counts. Other things like medical bills, tax obligations, or even money you owe to friends or family would also be included. It's any money that needs to be paid back.

It's important to be thorough here. Sometimes people forget about smaller debts, or perhaps a loan they took out a while ago. Every bit of money you owe needs to be counted to get a true picture of your financial situation. So, gathering these figures is, frankly, very important.

Subtracting What You Owe - how to estimate your net worth

Subtracting what you owe means making a list of all your outstanding financial obligations and adding them up. Get your latest statements for all your loans and credit cards. The amount shown as due is the figure you'll use. You're looking for a current, pretty accurate total of your liabilities.

Just like with assets, you want to be complete but not get bogged down in tiny details that don't really move the needle. A good estimate, a close guess, of your total debt is what you're after. This will give you the second part of the equation needed to figure out how to estimate your net worth.

Once you have the total of your debts, you'll take that number and subtract it from the total value of your assets. The resulting number is your net worth. It’s a simple calculation, but it gives you a very clear view of your financial standing, you know.

Are There Different Ways to Figure Out Your Net Worth?

While the basic formula for net worth (assets minus liabilities) stays the same, there are slightly different approaches to how precise you want to be with your numbers. Some people prefer a very detailed accounting, while others are happy with a quicker, more general guess. It really depends on your purpose, basically.

For a quick check, you might just include your bank balances, major investments, your home's value, and your main loans. This gives you a rough estimate, a quick approximation, which can be useful for a general overview. It's like a fast sketch of your financial picture, you could say.

For a more detailed look, you'd include every single asset and every single liability, no matter how small. This takes more time but gives you a more precise figure. Both ways are valid, depending on what you need the number for. So, there's no single "right" way to do it, just different levels of detail, really.

Approximating Your Financial Picture - how to estimate your net worth

Approximating your financial picture means accepting that some values will be close guesses rather than exact figures. For instance, the value of your car changes constantly, so using a recent online valuation is a good enough estimate. You're not going to get a perfect number, and that's perfectly okay.

The goal is to get a useful number, one that helps you make decisions and track progress. A good estimate, a close enough calculation, is far better than no calculation at all. Don't let the idea of needing absolute precision stop you from getting started, anyway.

This approach makes the process of how to estimate your net worth much less intimidating. It allows you to focus on the big picture and the trends, rather than getting stuck on minor details that might not matter as much in the long run. It's about progress, not perfection, frankly.

What Should You Do With This Number?

Once you have your net worth figure, what's next? Well, this number isn't just for looking at. It's a tool for planning and making smarter choices about your money. Think of it as a scoreboard for your financial game. You want to see that score go up over time, naturally.

You can use this number to set goals. Maybe you want to increase your net worth by a certain amount each year. Or perhaps you want to reach a specific net worth by a certain age. Having a target gives you something to work towards, which is, you know, pretty motivating.

It also helps you see the impact of your financial actions. If you pay off a big chunk of debt, your net worth will increase. If you make a smart investment, it will likely go up too. This feedback can help you stay on track and feel good about your efforts, actually.

Making Sense of Your Net Worth Figure - how to estimate your net worth

Making sense of your net worth figure involves looking at it in context. It's not about comparing yourself to others, but about comparing yourself to your past self. Is your number moving in the right direction for you? That's the main question to ask. It’s a pretty personal metric, after all.

If your net worth is negative, don't despair. Many people start there, especially earlier in life with student loans or a mortgage. The important thing is to have a plan to move it into positive territory. This figure simply shows where you are, not where you'll always be. It's a starting point for improvement, you see.

This figure helps you understand the bigger picture of how to estimate your net worth and how it fits into your overall financial plan. It's a single number that tells a pretty big story about your financial health, and it helps you keep your eye on the prize, so to speak.

How Often Should You Check Your Net Worth?

How often you check your net worth is really up to you and what feels right. Some people like to do it every month, especially if they are actively working on big financial goals. Others might prefer a quarterly check-in, or even just once a year. There's no strict rule, naturally.

A good cadence is often once every three to six months. This gives enough time for your efforts to show some progress, but it's not so frequent that you get bogged down in tiny fluctuations. It's about getting a periodic estimate, a regular approximation, of your financial standing. This kind of rhythm can be helpful.

The main idea is to do it consistently. Whatever schedule you choose, stick with it. This regular check-in helps you stay aware of your financial situation and make adjustments as needed. It's a simple habit that can have a pretty big impact over time, you know.

Keeping Tabs on Your Financial Progress - how to

How to Calculate Your Net Worth - Experian

How to calculate your net worth – Personal Finance Club

How To Calculate Your Net Worth? A Comprehensive Guide – Who Facts