Net Worth 40 - Your Financial Picture At Forty

Turning forty can feel like a pretty big moment, can't it? It's a time when many of us start to really look at our lives, where we've been, and where we might be headed. For lots of folks, this includes taking a good, honest look at their money situation. You might find yourself wondering about your financial standing, perhaps comparing it to others, or just trying to get a clearer sense of what you've built up so far. It's a natural point of reflection, you know, like taking a brief pause to check your bearings before the next part of your life unfolds.

When people talk about your "net worth," they're essentially talking about the total value of everything you own once you subtract what you owe. Think of it as a snapshot of your financial health at a specific point in time. It includes things like money in your savings, investments, the value of your home, and even your car. Then, from that total, you take away any debts you have, such as a mortgage, car loans, or credit card balances. What's left over is your net worth. It’s a pretty simple idea, actually, but it tells a rather important story about your economic standing.

So, why does this number matter particularly as you approach or pass the big 4-0? Well, by this age, many people have had some years in the workforce, perhaps started a family, or maybe even bought a home. You've had a chance to save a little, maybe invest some, and, of course, probably taken on some debt too. Forty often marks a midpoint in a career, and it's when thoughts of retirement, children's education, or even a different kind of future start to become more concrete. Knowing your net worth at this stage helps you see if you're on track for those bigger life goals, or if you might need to adjust your plans a bit. It’s really just a way to gauge your progress, you know, sort of like checking the fuel gauge on a long drive.

Table of Contents

- What Does "Net Worth" Really Mean for Someone at Forty?

- How Do We Figure Out Our Net Worth 40?

- What Might Affect Your Net Worth at Forty?

- Is There a "Right" Number for Net Worth 40?

- Simple Ways to Improve Your Net Worth as You Reach Forty

- Thinking About Your Net Worth 40 - What Comes Next?

- Moving Forward with Your Financial Picture

What Does "Net Worth" Really Mean for Someone at Forty?

When we talk about net worth, it's really a way of summing up your financial situation in one simple figure. It’s about taking everything you possess that holds monetary value, often called your "assets," and then subtracting everything you owe to others, which are your "liabilities." So, to be honest, it’s a pretty straightforward calculation once you gather all the numbers. Your assets could include the money sitting in your checking and savings accounts, any investments you have like stocks, bonds, or mutual funds, and perhaps retirement accounts such as a 401(k) or an IRA. It also takes into account the value of bigger items, like your home, any other real estate you might own, or even vehicles.

On the other side of the ledger are your liabilities. These are the things that take money out of your pocket or represent a future obligation. This typically means your mortgage balance, any car loans you have, student loans that are still hanging around, and, of course, credit card balances. It might also include personal loans or any other money you owe to someone else. The goal, naturally, is to have your assets be much larger than your liabilities, creating a positive net worth. A positive net worth means you have more things of value than you have debts, which is generally what you're aiming for as you get older. At forty, this number often starts to show some real growth, reflecting years of earning and saving, or at least, that’s the hope for many.

How Do We Figure Out Our Net Worth 40?

Calculating your net worth at forty is, in some respects, quite a simple process. You just need to gather some figures and do a little bit of arithmetic. First, you list all your assets. This means looking at your bank statements for checking and savings accounts, getting statements for any investment accounts like brokerage accounts or retirement funds, and finding out the current market value of your home. You can usually get a good estimate for your home’s value from online tools or by checking recent sales in your area. Don't forget other valuable possessions like cars, although their value tends to drop rather quickly.

Once you have a good handle on all your assets, you then turn to your liabilities. This involves pulling up statements for your mortgage, car loans, student loans, and any credit card debts. Write down the outstanding balance for each of these. After you have both lists, you simply add up all your assets to get a total, and then add up all your liabilities for their total. The final step is to subtract your total liabilities from your total assets. The number you get is your net worth. It’s a pretty clear way to see where you stand financially, you know, a simple score card for your money. Doing this regularly, perhaps once a year, can help you track your progress and see if your financial actions are actually moving you in the right direction.

What Might Affect Your Net Worth at Forty?

A lot of different things can play a part in what your net worth looks like when you hit forty. For instance, your career path and how much you earn over the years certainly make a big difference. Someone who has had a steady job with good pay raises and has been able to save a portion of that income will, naturally, tend to have a higher net worth. But it's not just about how much money comes in; it's also very much about what you do with it. Your saving habits, for example, are incredibly important. Consistently putting money aside, even small amounts, can really add up over time, especially with the power of compounding.

Debt also plays a rather significant role. Having a lot of high-interest debt, like credit card balances that just keep growing, can eat away at your net worth, even if you have a decent income. On the other hand, a mortgage, while a large liability, is often tied to an asset (your home) that tends to increase in value over the long term, so it’s a different kind of debt. Investment choices also matter quite a bit. Where you put your savings, whether it’s in low-risk savings accounts or higher-growth stock market investments, can really change how quickly your assets grow. And, of course, life events, like getting married, having children, or even unexpected health issues, can all affect your financial picture, sometimes in ways you couldn't have predicted. It’s all part of the story of your money, you know, the choices and the circumstances that shape your financial reality.

Is There a "Right" Number for Net Worth 40?

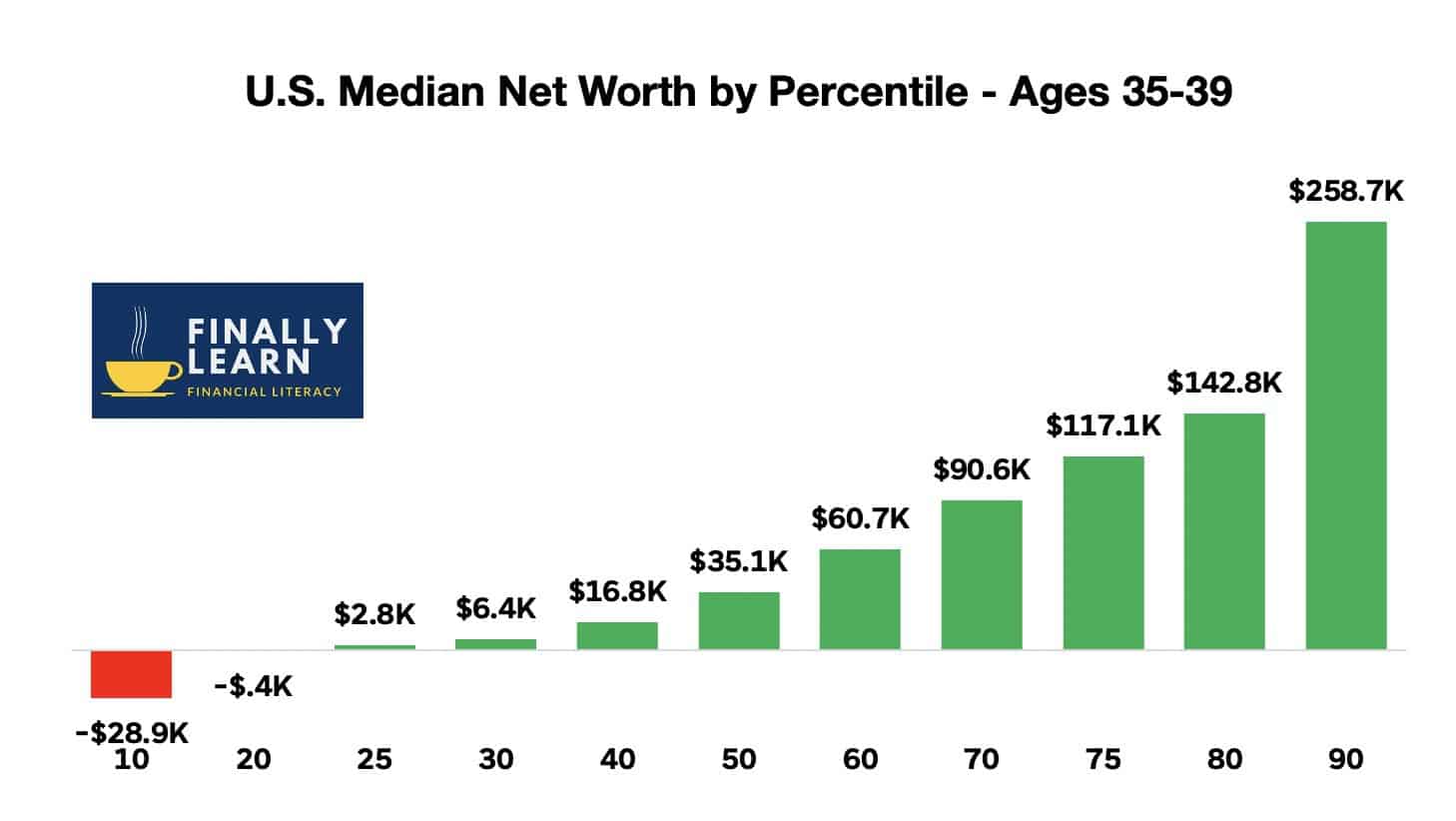

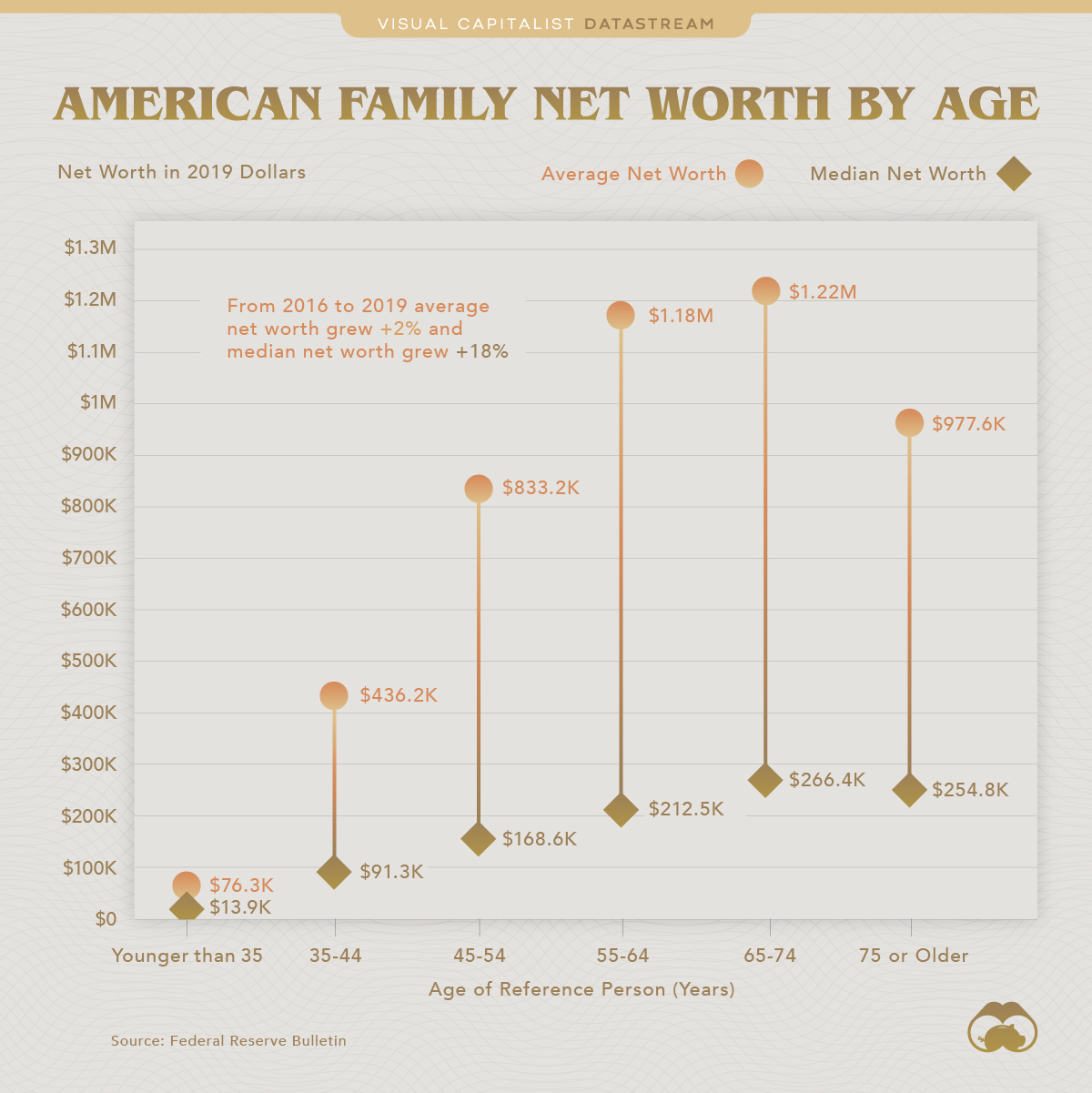

Many people wonder if there’s a specific amount of money they "should" have saved by the time they reach forty. Honestly, there isn't one single "right" number for your net worth 40. Everyone’s situation is so very different, and what's suitable for one person might not be for another. Things like where you live, whether you have children, your career path, and even your personal goals all play a part in what a reasonable net worth looks like for you. Some financial guides suggest aiming for a net worth that is two to three times your annual salary by forty, but these are just general guidelines, you know, more like suggestions than hard rules.

It's more helpful, perhaps, to think about your net worth in relation to your own life and aspirations. Are you comfortable with your current financial standing? Do you feel like you're making progress towards your longer-term goals, like retirement or a child's education? Comparing yourself to national averages can sometimes be misleading because averages can be skewed by a few very wealthy individuals. Instead, it might be more useful to look at median figures, which represent the middle point, giving a better sense of what a typical person might have. Even then, your personal circumstances are the most important factor. The "right" number is the one that allows you to feel secure and on track for the future you want to build, which is, in a way, a very personal definition of success.

Simple Ways to Improve Your Net Worth as You Reach Forty

If you're looking to boost your net worth as you approach or pass forty, there are some pretty straightforward things you can do. One of the most impactful is to simply save more money. This might sound obvious, but finding ways to cut down on unnecessary spending and directing those extra funds into a savings account or, even better, an investment account, can make a huge difference over time. Even small, consistent contributions can grow significantly, thanks to the magic of compounding returns. Think about setting up an automatic transfer from your checking account to your savings or investment account each payday. This makes saving a regular habit, which is, in fact, incredibly powerful.

Another effective strategy is to pay down high-interest debt. Credit card balances, for example, can carry very high interest rates, meaning a large portion of your payments goes towards interest rather than reducing the actual amount you owe. Getting rid of this kind of debt frees up more of your money to be saved or invested, directly increasing your net worth. You could also explore ways to increase your income. This might involve asking for a raise at your current job, taking on a side gig, or even learning new skills that could lead to a better-paying position. Every little bit of extra income, especially if you save a good chunk of it, can really help your net worth grow.

Investing wisely is also a key component. As you get older, your investment strategy might shift slightly, but continuing to put money into diversified investments that align with your risk tolerance is generally a good idea. This could mean contributing more to your retirement accounts, or opening a general investment account. Remember, the goal is for your money to work for you, which is, honestly, one of the best ways to build wealth. Lastly, keeping an eye on your expenses and making sure you’re not overspending on things that don’t add value to your life can also free up funds for saving and investing. It’s all about making conscious choices with your money, you know, directing it where it can do the most good for your financial future.

Thinking About Your Net Worth 40 - What Comes Next?

Once you've taken a look at your net worth 40, you might be wondering what steps to take next. The most important thing is to use this information as a guide, not a judgment. If your net worth isn't quite where you hoped it would be, that's perfectly okay. The good news is that forty is still a relatively young age, and there's plenty of time to make adjustments and improve your financial standing. You could start by setting some clear, achievable financial goals. Perhaps you want to pay off a specific debt, save a certain amount for retirement each year, or put money aside for a down payment on a bigger home. Having specific goals gives you something to work towards, which is, really, quite motivating.

You might also consider talking to a financial planner. They can offer personalized advice based on your unique situation and help you create a solid plan for the future. They can help you understand investment options, tax implications, and how to best allocate your resources to meet your objectives. Even if you feel pretty good about your net worth, a planner can often spot opportunities you might have missed or help you optimize your current strategies. It’s like having a knowledgeable guide for your money, you know, someone who can help you see the path ahead more clearly. The main idea is to keep learning and keep making thoughtful choices about your money.

Moving Forward with Your Financial Picture

Thinking about your net worth at forty is really about taking an active role in shaping your financial future. It's not just a number; it’s a reflection of your past decisions and a tool for making better ones going forward. As you move past this milestone, remember that building wealth is often a steady process, not a sudden event. There will be ups and downs, but consistent effort and smart choices tend to yield positive results over time. Keep an eye on your expenses, look for opportunities to increase your income, and make sure your savings are working hard for you.

It’s also helpful to revisit your net worth calculation periodically, perhaps once a year, just to see how things are progressing. This allows you to celebrate your successes and identify areas where you might need to adjust your approach. Financial planning is an ongoing activity, not a one-time task. The more engaged you are with your money, the more control you'll feel over your financial destiny. So, keep learning, keep planning, and keep working towards the financial security and freedom you desire. It’s all part of building a life you truly want, you know, one thoughtful step at a time.

Average Net Worth by Age 40 - Finally Learn

Charted: Visualizing Net Worth by Age in the United States

What should my net worth be by age group (with and without homes