Six Flags Net Worth - A Look At Its Financial Standing

Exploring the financial picture of Six Flags, a name that probably brings to mind thrilling rides and family fun, is quite interesting, isn't it? We're going to take a closer look at what makes up a big company's financial health, especially for one that gives so many people exciting times. It's more than just ticket sales, you know, when you consider all the moving parts.

This kind of financial picture, often called "net worth," helps us get a sense of how a company is doing financially, how much it's worth, more or less, after everything is accounted for. It's a way to measure its overall value in the business world, you see, giving us a pretty good idea of its standing.

For a company like Six Flags, which has parks all over, its net worth is a pretty big deal, so, reflecting its properties, its brand, and its operations. It’s about the total sum of its parts, you could say, and what that grand total comes to after subtracting what it owes.

Table of Contents

- Introduction

- What Makes Up a Company's Net Worth?

- How Do We Assess Six Flags' Net Worth?

- The Value of Thrills and Brand Power

- What Factors Influence Six Flags' Net Worth?

- The Operational Side of Six Flags' Net Worth

- Market Perception and Investor Interest in Six Flags' Net Worth

- Looking Ahead for Six Flags' Net Worth

- How Does the Market See Six Flags' Net Worth?

What Makes Up a Company's Net Worth?

When people talk about a company's net worth, they are really talking about its total value once you subtract all the money it owes from everything it owns. It's a bit like figuring out what someone has left after paying off all their bills and loans. For a big business, this means adding up all its possessions, whether those are buildings, land, cash in the bank, or even things that aren't physical, like its good name or special designs. Then, you take away all its financial duties, such as money borrowed, unpaid bills, and other financial commitments. The number that's left over gives you a picture of its financial strength, more or less, at a particular moment in time. This figure can shift, you know, depending on how the business is doing and what's happening in the wider economy. It's a pretty important number for anyone trying to understand a company's overall health.

For a company that operates theme parks, its possessions include a whole lot of different things. Think about all the land where the parks sit, the massive roller coasters, the water rides, and all the smaller attractions. There are also the buildings, like gift shops, restaurants, and offices, that are part of each park. Beyond the physical stuff, there's also the money it has on hand, any investments it has made, and even the value of its well-known brand name. The Six Flags name itself carries a certain value, you see, because so many people recognize it and associate it with fun. On the other side of the ledger are its financial duties. This would include any loans taken out to build new rides or buy land, payments owed to suppliers, and other financial promises. So, in a way, it's a constant balancing act between what the company has and what it needs to pay out.

How Do We Assess Six Flags' Net Worth?

To figure out something like Six Flags' net worth, you generally look at a few key things. First off, you'd consider all the physical items the company owns. This includes the actual land each park sits on, which can be quite a lot of acreage, and the sheer number of rides and attractions. Think about all those steel structures and mechanical systems that make the coasters go, so, they represent a significant investment. Then there are the buildings, the equipment for food service, the merchandise inventory, and all the vehicles used for operations. These are often called "tangible assets" because you can touch them, you know, and they have a clear physical presence. It’s a bit like counting all the furniture and appliances in a house when you're trying to figure out its worth.

Beyond the physical things, there are also "intangible assets" that play a very big part in Six Flags' net worth. This includes the value of its brand name itself. People know "Six Flags," and that recognition has a financial worth because it helps bring in visitors. There are also things like patents for ride designs, trademarks for park characters or logos, and even the general reputation the company has built over many years. These things are harder to put a precise number on, but they definitely add to the company's overall value. On the other side, you have to account for all the company's financial duties. This means looking at any long-term loans it has taken out, like for park expansions or big new rides, and also shorter-term obligations, such as payments to suppliers or employee salaries that are still due. Subtracting these from the total of what it owns gives you a pretty good picture of Six Flags' net worth, in some respects.

The Value of Thrills and Brand Power

The very core of Six Flags' business is providing exciting experiences, and the value of these thrills, along with the strength of its brand, is a huge part of its overall worth. When people think of roller coasters and family fun, Six Flags often comes to mind, and that kind of recognition isn't just for show; it actually has a financial impact. A well-known brand means that marketing efforts can be more effective, as people already have a positive association with the name. It helps bring in repeat visitors and also makes it easier to attract new ones. The brand's power is tied to the memories and experiences people have had at the parks, you know, which creates a kind of loyalty. This connection makes it more likely that families will choose a Six Flags park over other entertainment options, which directly influences ticket sales and other spending within the park. So, in a way, the good feelings and excitement it creates translate into real financial value.

Consider the emotional connection people have with theme parks. For many, a visit to Six Flags is a cherished tradition, a place for special moments and shared laughter. This emotional attachment, while not something you can easily count, certainly plays into the brand's strength and, by extension, its worth. The company's ability to consistently deliver memorable experiences builds a strong reputation, which is a valuable asset in itself. This reputation can attract sponsorships, partnerships, and even talent, all of which contribute to the company's bottom line. The brand's reach extends beyond just the parks; it includes merchandise, media appearances, and general public awareness. All these elements work together to build a robust brand presence that supports the overall financial standing. It’s almost like the brand itself is a giant magnet, drawing in all sorts of positive attention and financial opportunities.

What Factors Influence Six Flags' Net Worth?

Many things can make Six Flags' net worth go up or down, you know. One of the biggest factors is how many people actually visit the parks. More visitors usually mean more money coming in from tickets, food, drinks, and souvenirs. So, anything that affects attendance, like the weather, school holidays, or even how much extra money people have to spend on entertainment, can have a big impact. If there's a really hot summer, or a lot of rain, that might keep people away, which then affects the daily earnings. On the flip side, a new, exciting ride can really draw in the crowds and boost those numbers. It's a pretty direct link, you could say, between the number of smiling faces at the gate and the company's financial health.

Another important thing that influences Six Flags' net worth is how well they manage their costs. Running a theme park is expensive, honestly. There's the cost of keeping the rides safe and in good working order, paying all the staff, buying supplies for food and merchandise, and covering utility bills. If the company can find ways to run things more efficiently, perhaps by using less energy or getting better deals on supplies, that can help improve its financial picture. Also, the overall state of the economy plays a very big role. During times when people have less money to spend, they might cut back on things like theme park visits, which can affect earnings. Conversely, a strong economy often means more disposable income for families, leading to more visits and higher spending inside the parks. It’s a bit like a big ship, you know, being affected by the currents of the economy.

The Operational Side of Six Flags' Net Worth

Looking at the operational side of things gives us a clearer picture of what contributes to Six Flags' net worth on a day-to-day basis. This isn't just about the big, flashy rides, but also about the constant work that goes into keeping the parks running smoothly and profitably. Think about the daily maintenance of every single ride, ensuring they are safe and operational. There's a whole team of people dedicated to inspections, repairs, and keeping everything in tip-top shape. Then there's the staffing: thousands of employees from ride operators and food service workers to guest services and security personnel. Their salaries and benefits represent a significant ongoing cost, but they are also essential for providing a good visitor experience. So, it's a careful balance, you know, between providing excellent service and managing those payroll expenses.

Beyond the immediate operations, there's also the strategic side of how the parks are managed. This includes decisions about pricing for tickets, season passes, and in-park purchases. How much should a hot dog cost? What's the right price for a souvenir t-shirt? These seemingly small decisions add up to a lot of money over time. There's also the planning for new attractions. Building a new roller coaster or a themed area is a massive investment, and the company has to decide if the potential increase in visitors and revenue will justify the upfront cost. These capital expenditures are a big part of how the company grows its assets, which in turn affects its net worth. The efficiency of these operations, how well they control their spending while still offering a good time, really does impact the company's overall financial health, pretty much.

Market Perception and Investor Interest in Six Flags' Net Worth

How the public and investors see Six Flags also plays a pretty big role in its net worth, especially since it's a publicly traded company. When people talk about "market perception," they mean how the company is viewed by those who might buy its stock or bonds. If investors believe the company is well-managed, has good growth prospects, and is financially stable, they are more likely to want to invest in it. This interest can drive up the value of the company's shares, which in turn affects its overall market value, a key component of its perceived worth. It's a bit like a popularity contest, you know, where a company's perceived health can influence its actual financial standing in the market. Positive news, like a successful new ride launch or strong quarterly earnings, can boost this perception.

Conversely, any negative news, such as a drop in attendance or unexpected operational issues, can cause investors to become less interested, potentially leading to a decrease in the company's share price. This is why public relations and clear communication with investors are so important for Six Flags' net worth. The company's ability to consistently meet or exceed financial expectations, and to show a clear plan for future growth, helps build investor confidence. This confidence isn't just about the numbers; it's also about the story the company tells about itself and its future. If the story is compelling and believable, it can attract more investment, which provides capital for future projects and, ultimately, contributes to a stronger financial position. Basically, how people feel about the company can really make a difference to its perceived value.

Looking Ahead for Six Flags' Net Worth

Thinking about the future of Six Flags' net worth involves considering how the company plans to grow and adapt. The entertainment industry is always changing, and what people want from a theme park can shift over time. So, the company needs to keep innovating, perhaps by adding new types of attractions, improving the guest experience, or even exploring new technologies to make visits more engaging. Investing in these new ideas and features is a way to ensure the parks remain appealing and continue to draw in crowds. This forward-looking approach is pretty important for maintaining and even increasing its financial standing. If they can stay ahead of the curve, you know, they're more likely to see their worth grow.

Another aspect of looking ahead involves how the company manages its financial obligations and makes smart choices about where to put its money. This could mean paying down existing debts, which would reduce its liabilities and directly improve its net worth. Or it might involve strategic acquisitions, like buying another park or a related business, which could add new assets and revenue streams. The ability to make these kinds of smart financial moves, while also keeping an eye on the overall economic situation, is key to its long-term health. The decisions made today about investments and operations will certainly shape what Six Flags' net worth looks like in the years to come, more or less. It’s a continuous process of planning and adapting to what’s next.

How Does the Market See Six Flags' Net Worth?

The market, meaning all the people and groups who buy and sell stocks, looks at Six Flags' net worth through a slightly different lens than just the balance sheet. They often consider what's called "market capitalization," which is the total value of all the company's shares that are available to buy. This number is a very dynamic measure, changing second by second as shares are traded. It reflects what investors collectively believe the company is worth right now, based on its current performance, its future prospects, and even general feelings about the economy. So, while the company's own calculations of assets minus liabilities give one picture, the market's view, you see, offers another, often more immediate, snapshot of its perceived value. It's a pretty good indicator of how much confidence people have in the company's future earnings and stability.

This market view of Six Flags' net worth is influenced by many things that go beyond just the numbers on a financial report. Things like news headlines, analyst reports, and even social media chatter can all play a part. If a well-known financial expert talks positively about the company, it might encourage more people to buy its stock, pushing the market value up. Conversely, negative news, perhaps about a safety incident or a dip in attendance, could cause the value to fall. It's a complex interplay of hard facts and general sentiment. The market is constantly weighing all available information, trying to predict how the company will perform in the future, and adjusting its valuation accordingly. This makes the market's view of Six Flags' net worth a constantly shifting target, basically, reflecting the collective optimism or pessimism of investors.

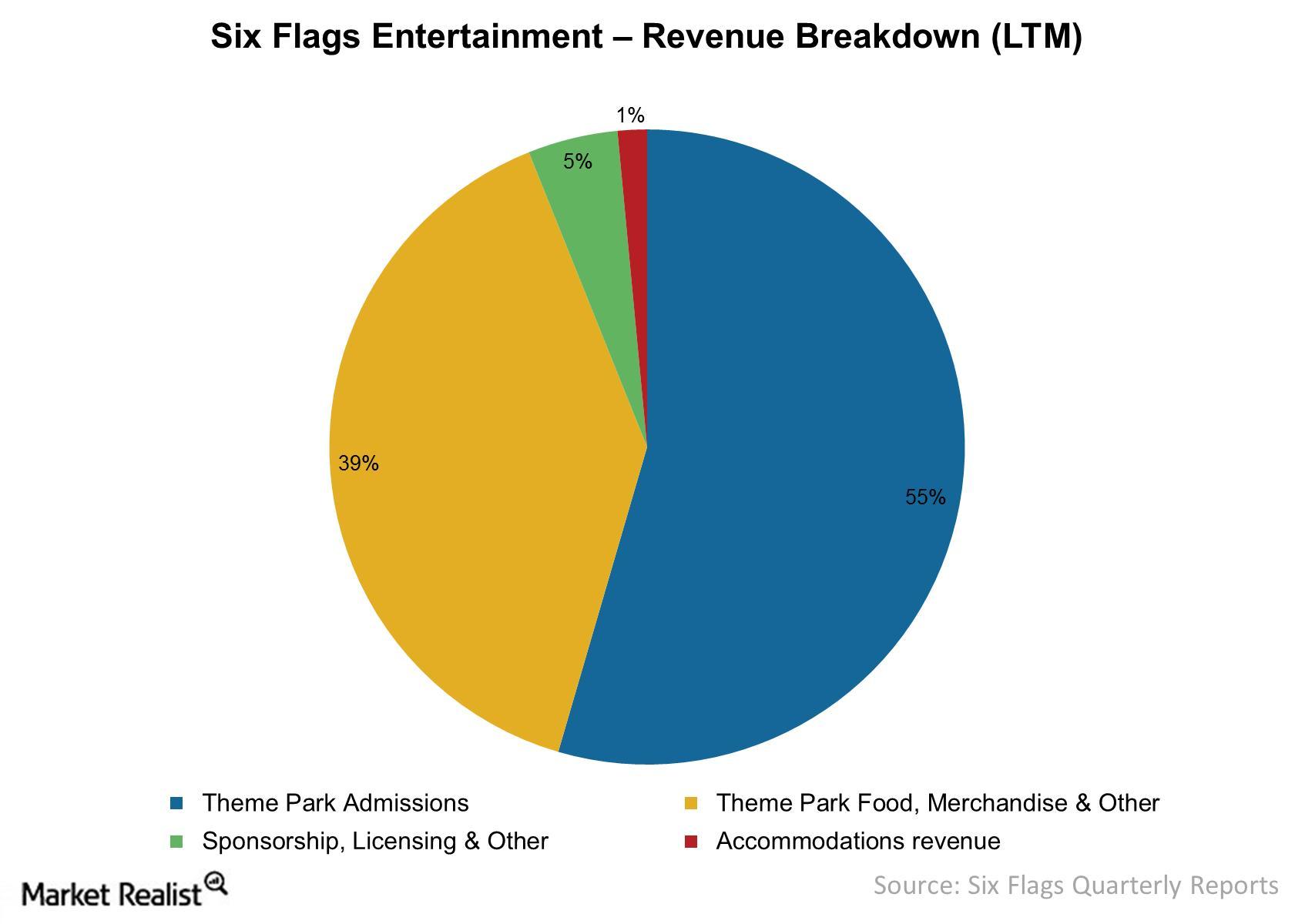

Must-know: How Six Flags generates its revenues

Six Flags CEO bought $3 million worth of Six Flags shares

Six Flags changing their season pass/membership structure AGAIN : r