US Median Net Worth - What It Means For You

Table of Contents

- What Does "Median Net Worth" Really Tell Us?

- Understanding Your Own Financial Standing

- How Does the US Median Net Worth Change Over Time?

- Factors That Shape the Us Median Net Worth

- Is Your Net Worth Similar to the US Median Net Worth?

- Different Paths to Building Wealth

- What Can People Do to Improve Their Us Median Net Worth?

- Steps to Growing Your Financial Picture

Thinking about money and what people have saved up often brings up a lot of questions. One number that pops up quite a bit is the "median net worth" for folks across the country. It gives us, you know, a sort of middle-ground look at how people are doing financially, offering a snapshot of what the typical household holds in terms of their overall money situation. This figure can feel a little abstract, but it actually speaks to the financial health of many families and individuals, giving a broad idea of what's common.

When we talk about "net worth," we are, in a way, just looking at what someone owns minus what they owe. So, if you have a house and some savings, but also a car loan and some credit card bills, your net worth is what is left over after those debts are taken out. The "median" part means we are not looking at an average, which can get skewed by a few people with very, very large amounts of money. Instead, the median is that point where half the people have more stuff, and half have less, which is, honestly, a much better picture of what most people experience.

This number, the us median net worth, matters a great deal because it helps us see how well people are building up their financial foundations. It is, in some respects, a quiet indicator of general financial comfort and future security for a lot of people. It tells us something about how folks are managing their money over time, and whether they are able to put aside funds for later, or perhaps own things that hold value. It is a way to sort of gauge the financial temperature of the nation, providing a useful benchmark for many.

What Does "Median Net Worth" Really Tell Us?

When we consider the us median net worth, it really gives us a sense of the typical financial standing for a household. It is not about the richest folks or those with very little, but rather about the large group in the middle. This number helps us understand the general financial situation for many families, showing what a typical household has in terms of their assets after taking out any money they owe. It is a way to look at the financial health of a large segment of the population, giving a pretty good idea of common financial realities. You know, it sort of sets a baseline for discussion.

The idea of a median is, in a way, very important here. If we used an average, a few people with a lot of money could make the number seem much higher than what most people actually have. But with the median, it means that if you lined up all the households by their net worth, the one right in the middle is the number we are talking about. This makes it a much more realistic measure for most people, giving a truer picture of financial well-being for a typical family unit. It is, basically, a more fair way to look at things.

So, when we see the us median net worth, it tells us about the financial resources available to the average family. This includes things like the value of their home, any money they have saved up, their retirement accounts, and even the worth of their cars or other possessions, minus things like mortgages, car loans, or credit card balances. It is a simple way to get a quick idea of how much financial cushion the typical household might have. This figure can show whether families are, you know, building up a solid base for their future or if they are just getting by.

Understanding Your Own Financial Standing

For individuals, knowing about the us median net worth can be a helpful point of comparison, but it is also important to remember that everyone's situation is unique. Your own financial picture depends on many things, like where you live, what kind of work you do, and the choices you make about saving and spending. So, while the median number gives a general idea, your personal financial standing might be, you know, quite different from that national figure. It is more about your own path.

Thinking about your own net worth means taking stock of everything you own that has value. This includes, perhaps, the equity in your home, any money in your bank accounts, investments, and even the value of things like jewelry or collectibles. Then, you subtract all your debts, which could be student loans, car loans, credit card balances, or a mortgage. The number you are left with is your personal net worth. It is a pretty straightforward calculation, actually, that gives you a clear snapshot.

Understanding your personal net worth is, in some respects, a really good way to track your financial progress over time. It is not just about comparing yourself to the us median net worth, but more about seeing how you are doing on your own financial journey. Are you building up more assets than debts? Is your financial picture getting stronger each year? These are the kinds of questions that a personal net worth calculation can help you answer. It is, basically, a personal financial report card.

How Does the US Median Net Worth Change Over Time?

The us median net worth does not stay the same; it moves up and down over the years. This is because a lot of things influence how much money people have and how much they owe. For example, when the economy is doing well, and people have steady jobs and their investments are growing, you might see this number go up. But if there is a downturn, or if a lot of people lose their jobs, then the median net worth could, you know, go down. It is a reflection of the larger economic story.

Changes in things like housing prices also play a very big part. For many families, their home is their biggest asset, so if home values go up, their net worth often goes up too. The same goes for the stock market; if people have money in retirement accounts or other investments, and those investments grow, their net worth gets bigger. These are pretty common ways that the overall financial picture for many people can shift. It is, like, a continuous adjustment.

Also, things like how much people are saving, or how much debt they are taking on, can change the us median net worth. If people are saving more and borrowing less, then the median net worth tends to increase. But if people are taking on more debt than they are saving, or if they are facing unexpected costs, then that can pull the number down. It is a constant balance between what people are bringing in and what they are spending or borrowing. So, it is almost a living number.

Factors That Shape the Us Median Net Worth

Many different things work together to shape the us median net worth. One big factor is, of course, how the economy is doing overall. When there are more jobs, and wages are going up, people have more money to save and invest, which can help their net worth grow. On the other hand, if jobs are scarce or wages are flat, it becomes harder for people to build up their assets. It is, basically, a fundamental connection.

Another thing that matters a lot is the cost of living in different places. The United States is, you know, a very big country with many different areas, from bustling cities to quiet rural spots. In some places, things like housing and everyday expenses are much more expensive, which can make it harder for people to save money and build up their net worth, even if their income seems good. This regional variation really does make a difference to the us median net worth when you look closely.

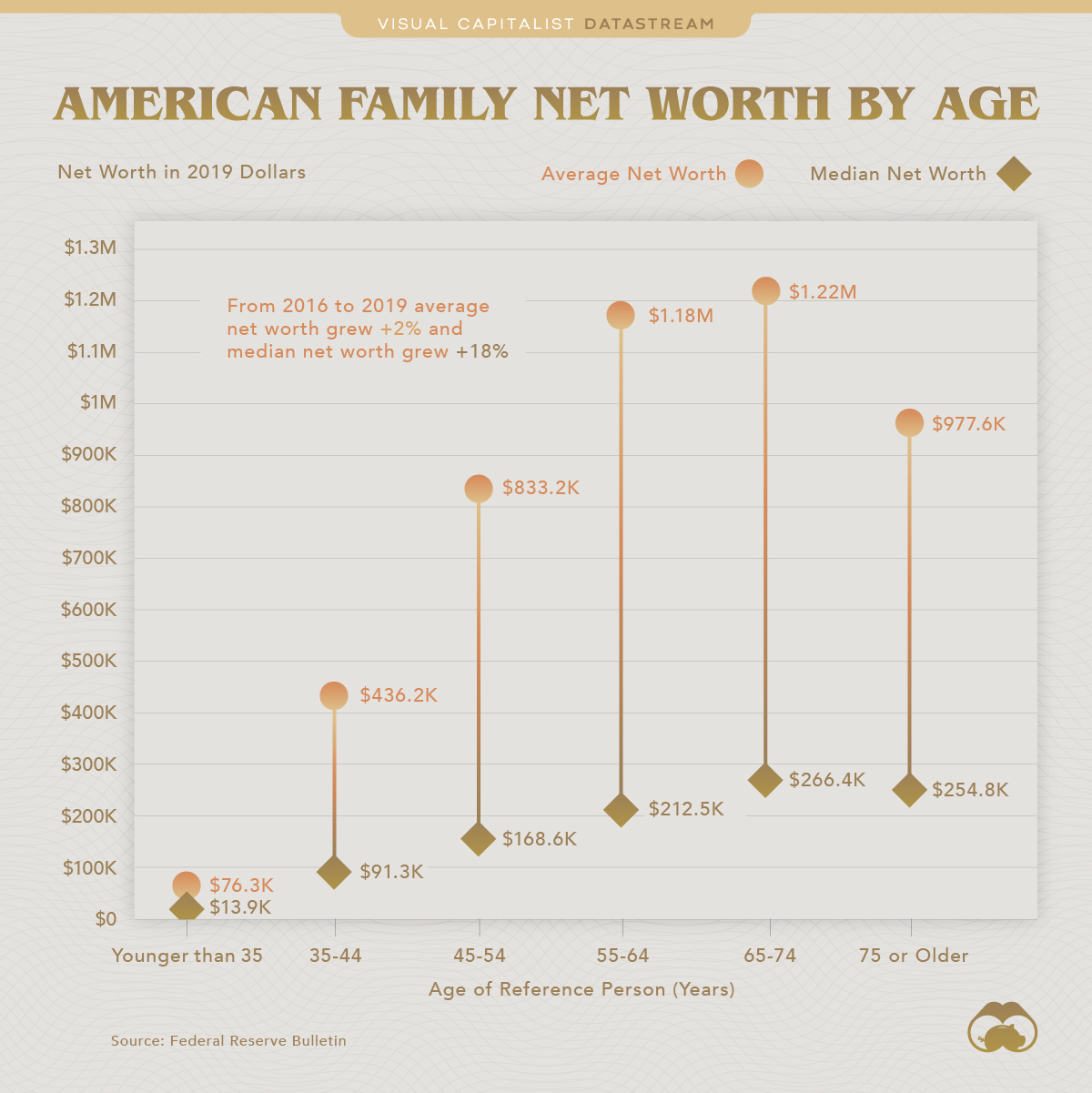

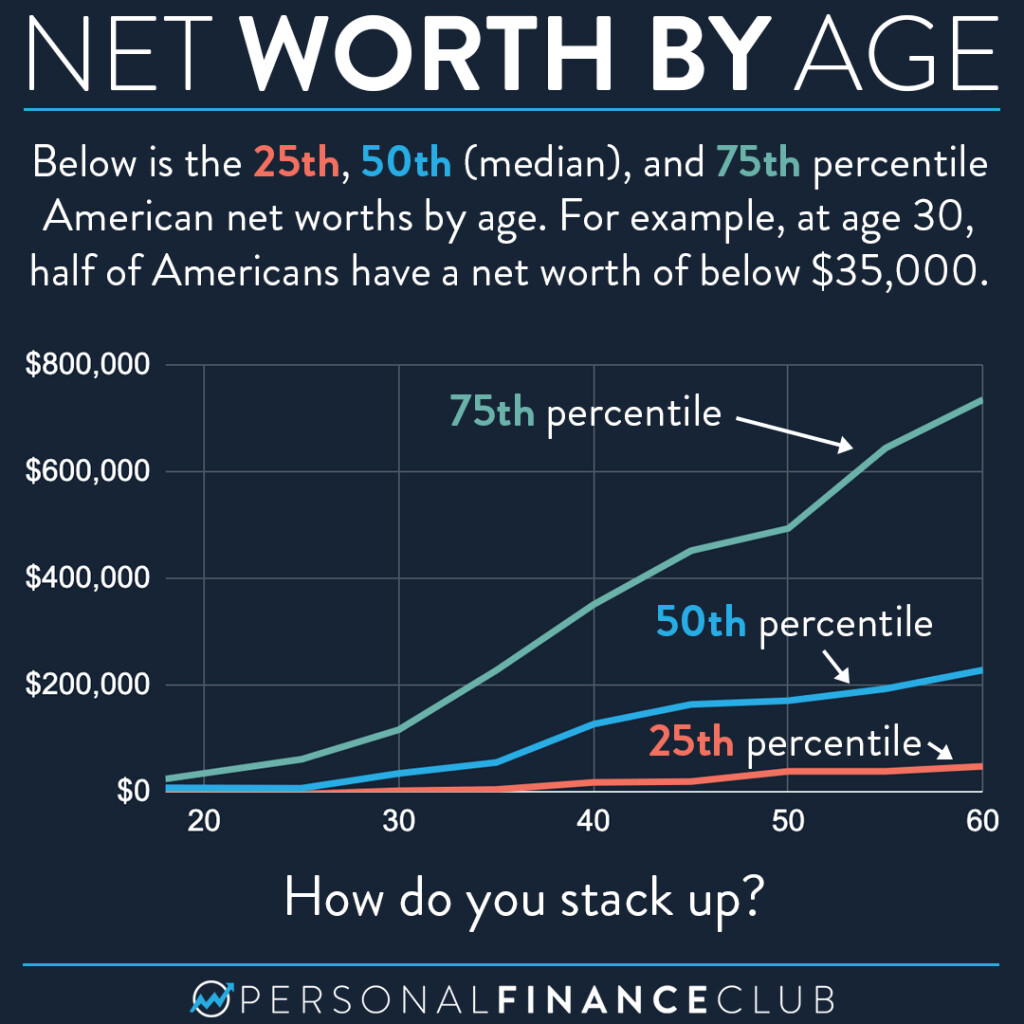

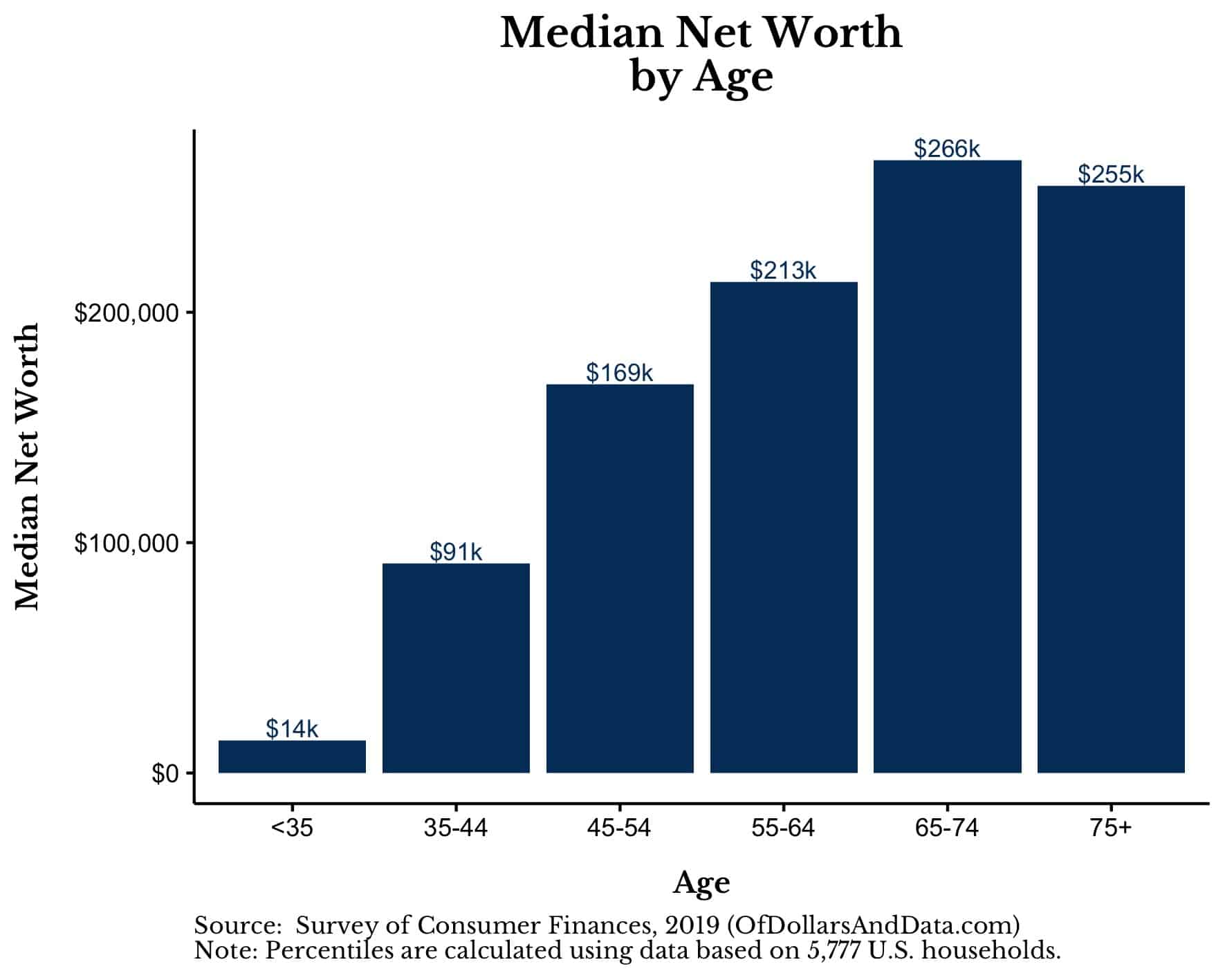

Education and age also play a role in shaping the us median net worth. Generally, people with more education tend to earn more over their lifetimes, which gives them more chances to save and invest. And as people get older, they usually have had more time to pay off debts and build up retirement savings, so their net worth tends to be higher. These are, you know, just some of the patterns we see when looking at financial data across the population.

Is Your Net Worth Similar to the US Median Net Worth?

It is natural to wonder if your own financial situation lines up with the us median net worth. However, it is really important to remember that this median is a national figure, and it averages out a huge variety of individual circumstances. Your own age, where you live, the kind of work you do, and your personal choices about money will all have a much bigger impact on your net worth than simply trying to match a national average. So, it is kind of like comparing apples and oranges sometimes.

For instance, a younger person just starting out might have a lower net worth, perhaps even a negative one if they have a lot of student loan debt, and that is perfectly normal for their stage of life. Someone closer to retirement, on the other hand, would typically have had many years to save and invest, so their net worth would likely be, you know, much higher than the overall median. The us median net worth does not really account for these different life stages, which is something to keep in mind.

Also, the cost of living varies a lot across the country, as we mentioned. Someone living in a very expensive city might have a higher income but also much higher expenses, making it harder to build up savings, even if they are earning a good salary. Meanwhile, someone in a less expensive area might have a lower income but also lower costs, allowing them to save more. So, your location can, you know, really change how your net worth looks compared to the national figure.

Different Paths to Building Wealth

There are many different ways people go about building their financial picture, and not everyone follows the same path to increase their us median net worth. Some people focus on saving a lot of their income, putting money into retirement accounts or other investments. Others might prioritize paying off debt quickly, like their mortgage, to reduce their liabilities and increase their equity. These are, you know, all valid approaches to financial growth.

For some, owning a home is a big part of their wealth-building strategy, as their home's value can grow over time, adding to their net worth. For others, investing in the stock market or starting their own business might be the main way they build assets. There is no single "right" way to do it, and what works best often depends on individual goals, risk tolerance, and circumstances. It is, basically, about finding what fits your situation.

Even small, consistent steps can add up over time. Regularly putting a little money aside, even if it does not seem like much at first, can make a significant difference over many years due to the way savings can grow. Avoiding unnecessary debt and making smart spending choices also play a big part in building a stronger financial picture. These habits, you know, can help anyone improve their personal net worth, regardless of where they start.

What Can People Do to Improve Their Us Median Net Worth?

When we talk about improving the us median net worth, it really comes down to individual actions that, when added up, make a difference for the whole. For most people, a good starting point is to get a clear idea of where their money is going. Creating a simple plan for spending and saving, often called a budget, can help people see what they are earning and what they are spending. This can, you know, reveal areas where they might be able to save a little more.

Another important step is to try and reduce any high-interest debt, like credit card balances. These kinds of debts can really eat away at a person's income, making it hard to save or invest. Paying them down can free up money that can then be used to build assets, which directly helps improve a person's net worth. It is, basically, a way to stop the financial drain and start building up.

Thinking about the long term is also very helpful. Putting money into retirement accounts, like a 401(k) or an IRA, is a powerful way to build wealth over many years. These accounts often have tax benefits, and the money can grow significantly over time. Even small, regular contributions can, you know, add up to a substantial amount later on, contributing to a higher us median net worth for everyone.

Steps to Growing Your Financial Picture

Growing your financial picture, and in turn contributing to the overall us median net worth, involves a few key steps that most people can take. One very practical thing is to set clear financial goals. Do you want to save for a down payment on a home? Are you aiming to pay off student loans? Having specific goals can give you a clear direction for your money. It is, you know, like having a map for your money journey.

Another step is to consistently save a portion of your income, no matter how small it seems. Even putting aside a little bit each payday can make a difference over time. Automating these savings, so the money goes directly from your paycheck into a savings account or investment, can make it much easier to stick to your plan. This simple habit can, basically, create a strong foundation for your financial future.

Learning a bit about investing can also be very helpful. You do not have to be an expert, but understanding how different types of investments work, like stocks or bonds, can help you make informed choices about where to put your money. Over time, smart investments can significantly boost your net worth. It is, in some respects, about making your money work for you, which helps lift the us median net worth for all.

Finally, protecting your assets is also a part of building a strong financial picture. This might mean having appropriate insurance, like health insurance or homeowner's insurance, to protect against unexpected costs that could otherwise wipe out your savings. It is about building a secure foundation, so your hard-earned money is, you know, safe from unforeseen problems. These are all pretty sensible things to consider.

The us median net worth gives us a central idea of how people are doing financially across the country. It is a figure that tells us about the typical financial resources available to households, representing what most people own after their debts are accounted for. This number changes over time, influenced by the economy, housing values, and individual saving habits. While it offers a national benchmark, personal net worth is shaped by individual circumstances like age, location, and financial choices. Understanding this median can help people think about their own financial standing and the various ways they can work towards growing their own financial well-being.

Charted: Visualizing Net Worth by Age in the United States

What is the median net worth by age? - Blog Posts - Personal Finance Club

The Average Net Worth by Age and Education Level