US Percentile Net Worth - What It Means For You

Thinking about your money and where you stand financially can feel a little bit like looking at a really big map, you know? It's almost as if everyone has their own little financial picture, and sometimes it's good to see how that picture fits into the larger landscape. When people talk about "net worth," they are really talking about what someone owns minus what they owe, and then, you know, comparing that to others in the country. This idea of a "us percentile net worth" helps us get a sense of how our personal financial situation compares to others across the United States.

Understanding where your financial resources place you among others in the country can be a useful way to think about your progress. It's not just about a single number, but rather, in some respects, about where that number falls within a broad range of financial situations held by people all over the nation. This comparison can give a person a bit of perspective on their own financial path, whether they are just starting out or have been building their resources for many years, you see.

So, this discussion will look at what this "us percentile net worth" idea truly means, how it comes together, and what factors might play a part in where someone finds themselves on that scale. We will, in a way, explore how the vastness and varied nature of the United States, a country made up of many states and different ways of life, might influence these financial standings for its people. It's really about getting a clearer picture of personal finances within the broader American setting.

Table of Contents

- What is Net Worth, Anyway?

- The American Financial Picture - A Look at Different Groups

- Does Where You Live in the US Affect Your Net Worth?

- Are There Resources to Help Improve Your US Percentile Net Worth?

- What Does the Future Hold for US Percentile Net Worth?

What is Net Worth, Anyway?

When people talk about net worth, they're simply adding up everything a person owns that has value and then taking away everything they owe. This includes things like money in the bank, investments, real estate, and even cars, all considered as assets. On the other side, there are things like credit card balances, student loans, and mortgages, which are considered debts. The difference between these two numbers gives you your net worth. It's, you know, a snapshot of your financial standing at a particular moment. This figure can go up or down over time, depending on how you manage your money and what happens in the wider economy, of course.

For example, if you own a house worth a good amount, but still have a large amount left on your home loan, your net worth will reflect that balance. Similarly, if you have a lot of money saved up but also carry some credit card debt, that will also be part of the calculation. It's a pretty straightforward way to look at someone's overall financial health, really. Many people use this number to track their financial progress over the years, seeing if their resources are growing or shrinking. It's a pretty useful tool for personal money planning, you see.

How Your US Percentile Net Worth is Calculated

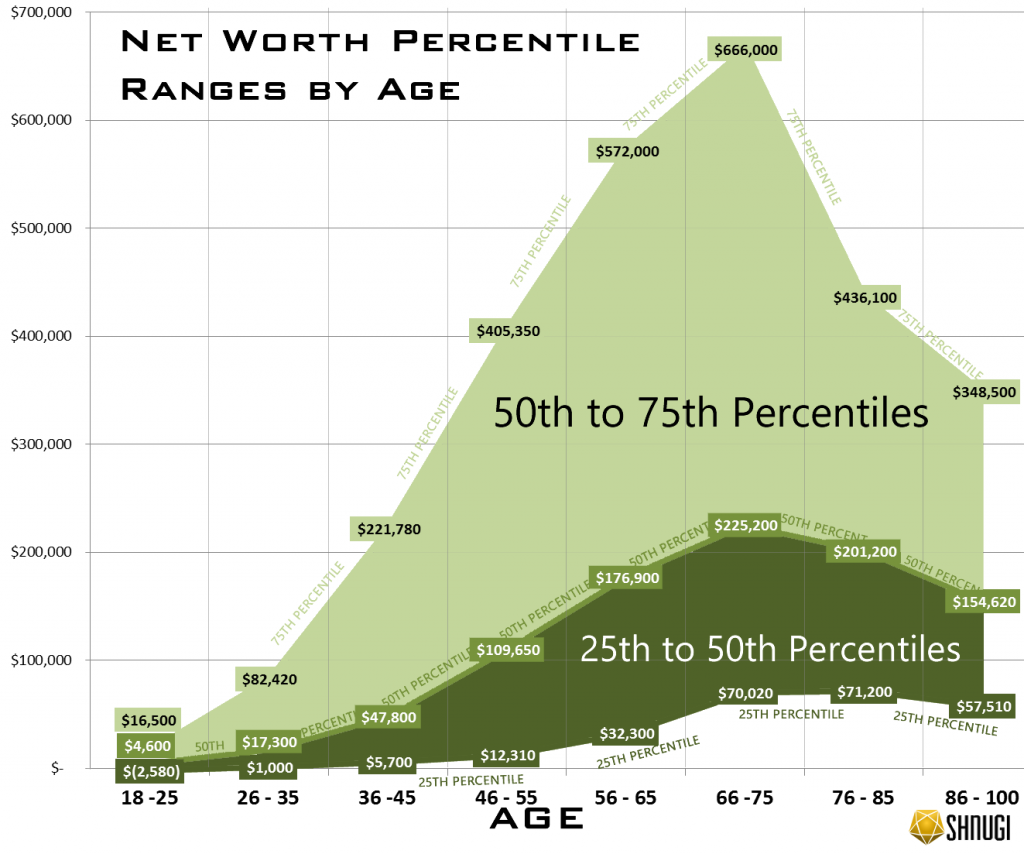

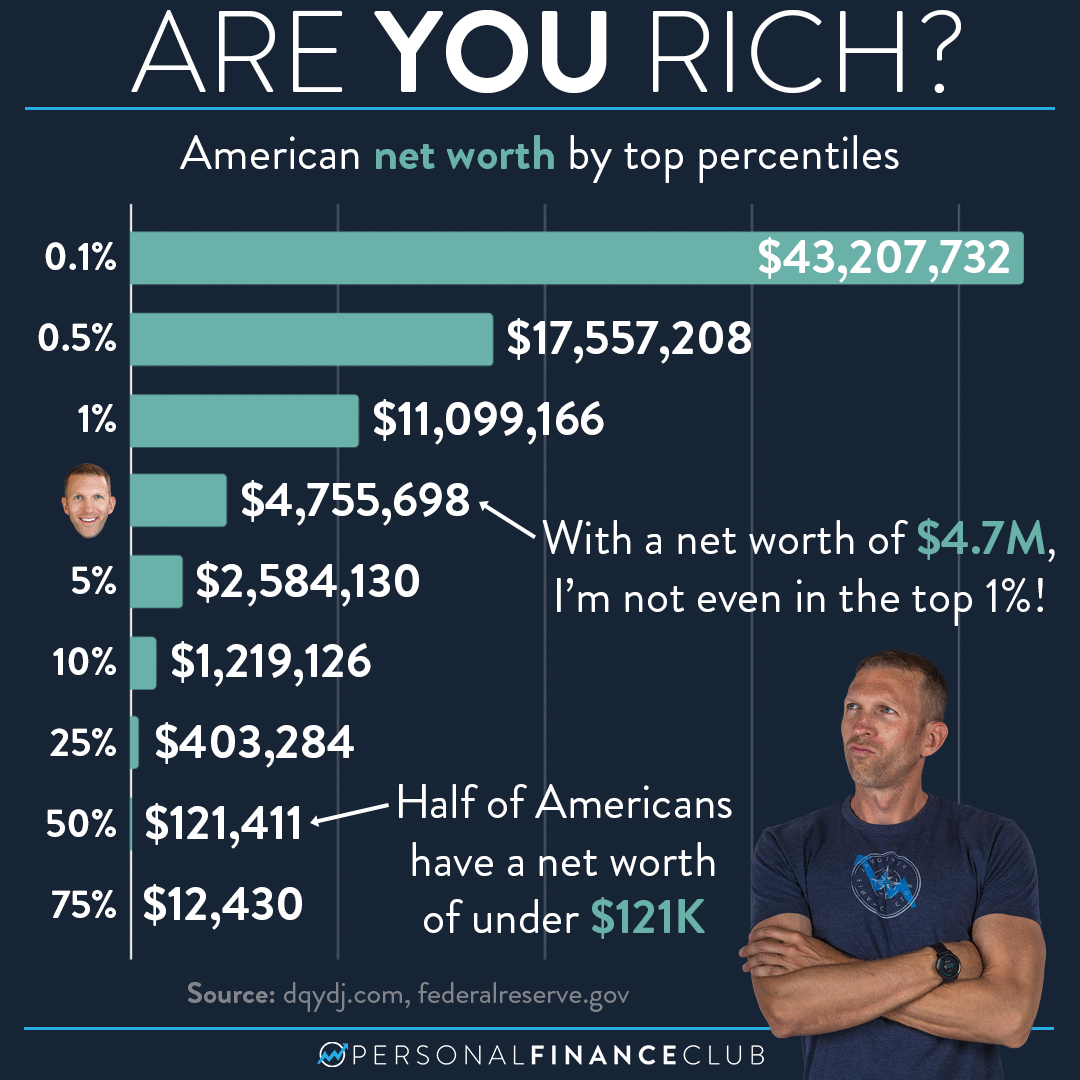

To figure out your "us percentile net worth," financial experts collect data from a great many households all over the country. They gather information on people's assets and their debts, just like we talked about. Once they have all this information, they arrange it from the lowest net worth to the highest. Then, they divide this long list into groups of one hundred. Each group represents one percentile. So, if you are in the 70th percentile, it means that your net worth is greater than 70 percent of the other households in the United States, and 30 percent have more than you. This is, you know, how these figures are put together.

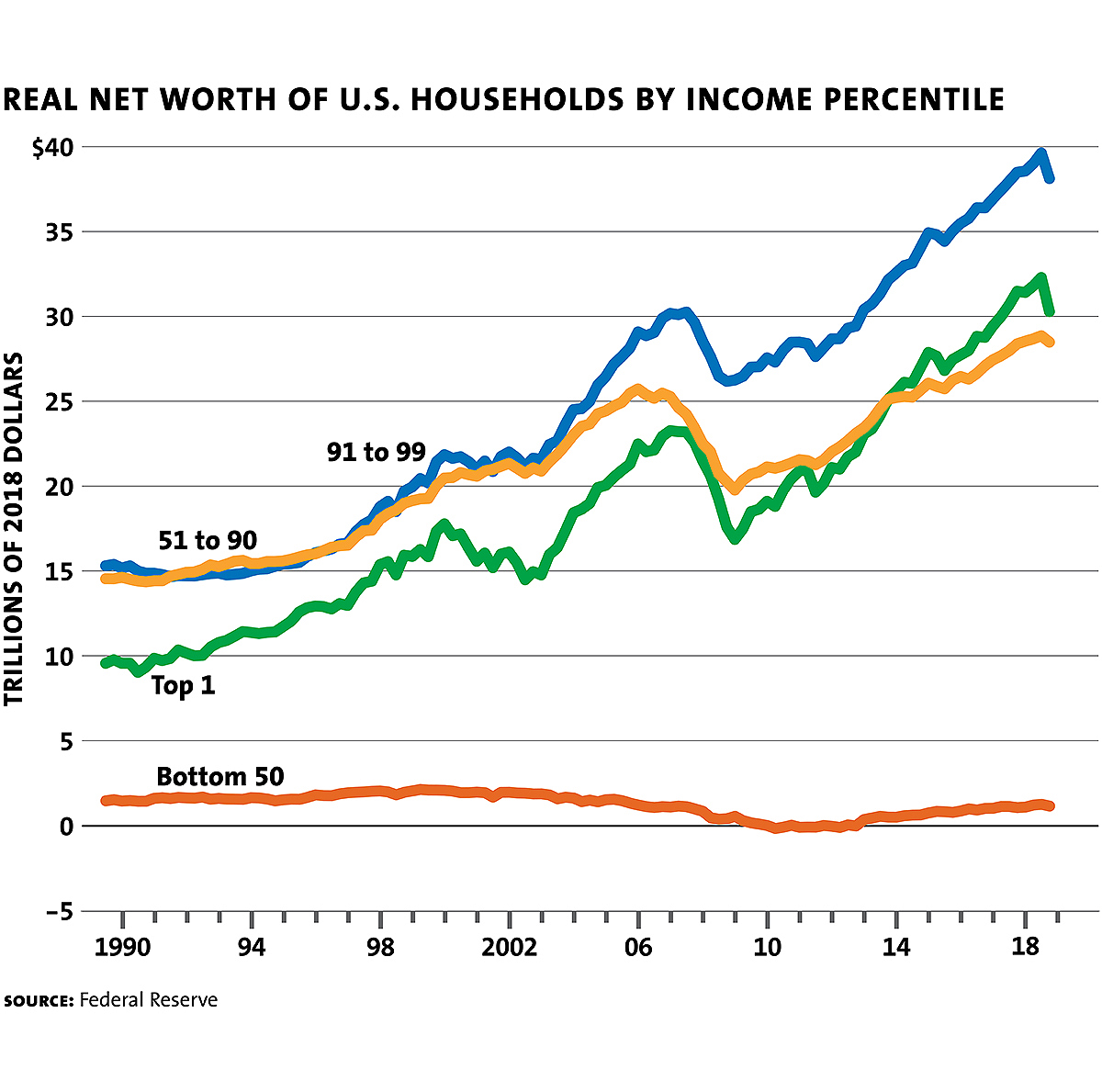

This kind of grouping helps to show the distribution of wealth across the nation. It's not just about what the average person has, but about the range of financial situations that exist. For instance, the very top percentiles will show significantly higher amounts, while the lower percentiles might even be negative, meaning some people owe more than they own. This picture of "us percentile net worth" helps us to see the bigger economic story of the country, how resources are spread out among its people, and that's pretty interesting, in a way.

The American Financial Picture - A Look at Different Groups

The United States, as a country made up of 50 states, has a huge variety of people and ways of life. This means that the financial picture across the nation is not at all uniform. Different groups of people, whether by age, background, or where they choose to live, often show different patterns in their financial standing. For instance, people who are older might, in general, have had more time to save and build up their resources, so their net worth tends to be higher. Younger people, on the other hand, might just be starting out, perhaps with student loans, so their net worth might be lower, or even negative, which is pretty common, actually.

The kind of work people do also plays a part. Some jobs pay more than others, and this can definitely affect how much someone can save or invest over time. Education levels, too, can influence earning potential and, by extension, a person's ability to gather resources. It's a bit like a mosaic, really, with many different pieces making up the overall image of financial well-being across the country. Each of these different elements contributes to the broad range of financial situations we see when we look at the whole country, you know.

Where Does Your US Percentile Net Worth Fit?

Thinking about where your own "us percentile net worth" fits in can be a way to gauge your personal financial journey. It’s not about feeling good or bad, but rather about having a clear idea of your standing. Perhaps you're just starting your career, and your current net worth might place you in a lower percentile. That's perfectly normal, as a matter of fact. As you work, save, and make financial choices, that number can change over time. It's more about the direction you are heading in and the plans you have for your financial future.

On the other hand, if you've been working for many years and have made good financial choices, your net worth might place you in a higher percentile. This shows the results of consistent saving and wise choices. It's important to remember that everyone's path is different, and these numbers are just one way of looking at things. They give us a way to compare, but they don't tell the whole story of someone's life or their individual circumstances, which is, you know, pretty significant.

Does Where You Live in the US Affect Your Net Worth?

Absolutely, the place you call home in the United States can have a big influence on your financial picture, and therefore, your net worth. The United States is a federal republic of 50 states, and each state, and even different areas within states, can have very different costs for things like housing, food, and everyday living. For instance, living in a big city on the coast, like those often seen in tourist information, might mean higher costs for a home, which could mean a bigger mortgage and potentially a lower net worth if your earnings don't keep pace. However, these areas might also offer higher-paying jobs, so it can be a bit of a balance, you see.

On the other hand, living in a more rural area or a smaller town might mean lower living costs. This could allow someone to save more money or pay down debts more quickly, which could help build up their net worth. The economic opportunities also vary from one part of the country to another. Some states might have thriving industries, while others might have fewer job prospects. These local economic conditions definitely play a part in how people build their financial resources, and that's just a fact, really.

Are There Resources to Help Improve Your US Percentile Net Worth?

Yes, there are quite a few resources available to help people manage their money and potentially improve their "us percentile net worth." The government itself offers many services and information points that can be helpful. For example, official government websites provide facts about laws, history, and statistics, which can include information about economic trends or financial programs. Knowing about things like social security, taxes, and government benefits can be very important for personal financial planning. These are, you know, parts of the bigger picture of how a person's money works.

Beyond government sources, many financial institutions and educational groups offer tools and advice. Online banking, for instance, makes it simple and secure to keep track of your money, pay bills, and manage your accounts. Learning about different ways to save or invest, understanding how loans work, or even just creating a simple budget can make a real difference. These tools and pieces of information are out there for pretty much everyone to use, and they can certainly help someone work towards a stronger financial position, which is definitely a good thing.

Understanding Government Support and Your US Percentile Net Worth

The government of the United States provides various services and programs that can directly or indirectly affect a person's financial standing and, by extension, their "us percentile net worth." For instance, learning about passports, social security, and taxes is really important. Social Security benefits, for example, are a future income stream for many people, which contributes to their overall financial security. Understanding tax laws helps people manage their money more effectively, as a matter of fact, by making sure they are taking advantage of any applicable deductions or credits.

Federal agencies and elected officials also play a role in creating policies that shape the economy. Foreign policy, for example, aims to advance the interests and security of the American people, and a stable economy generally helps people build their financial resources. Knowing how to find government benefits, services, and information through official sites can give people access to support that can help them with housing, healthcare, or other needs, which frees up other funds that can be saved or invested. These services are there to support people, and knowing about them is a really good step, you know.

What Does the Future Hold for US Percentile Net Worth?

Predicting exactly what the future holds for "us percentile net worth" is, frankly, a bit like trying to guess the weather a year from now. There are many things that can influence it, from broad economic trends to individual choices. Things like how the job market changes, what happens with inflation, and even global events can all play a part in how financial resources are distributed across the country. The government's actions, like those of the president and federal agencies, also have an influence on the overall economic health of the nation, you see.

However, what we can say is that for individuals, focusing on personal financial habits will always be important. Things like saving regularly, managing debt carefully, and making informed choices about investments tend to be good practices no matter what the larger economic picture looks like. The United States is a country with a vast and varied economy, and while the overall numbers might shift, individual efforts to build financial strength will always matter a great deal. It's about personal planning within that larger framework, basically.

This discussion has looked at the concept of "us percentile net worth," explaining what net worth means and how these percentiles are put together. We explored how different groups of people in the United States might find themselves in various financial situations. We also considered how where someone lives in the country can affect their financial standing. Finally, we touched upon the many resources available to help people improve their financial picture, including government support, and briefly considered what the future might bring for these financial measures.

Us Net Worth Percentiles 2024 - Kay Kalina

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

Us Net Worth Percentiles 2024 - Kay Kalina