USA Net Worth Percentiles - A Look At Financial Standing

In the vast stretch of land known as the United States of America, a country made up of fifty states and a federal district, people often wonder about their financial standing. It is a place where many different lives unfold, and naturally, folks become curious about how their personal wealth stacks up against others. Thinking about money and what you own, or perhaps what you owe, is a very natural thing to do, after all.

This kind of thinking, you see, often leads to questions about something called net worth percentiles. It is a way of looking at the collective financial picture, allowing us to get a sense of where different households sit on the economic ladder. We are not just talking about how much money someone earns each year, but rather the total value of everything they possess once their debts are taken out.

So, understanding these financial markers can give a person a clearer idea of their financial health, and perhaps even offer some insights into how others are doing across this large and diverse nation. It is a way to sort of gauge where you stand, financially speaking, within the wider population.

Table of Contents

- What Does Net Worth Even Mean?

- Understanding Your Place in USA Net Worth Percentiles

- How Do We Measure Financial Well-being in the USA?

- Different Age Groups and USA Net Worth Percentiles

- Why Do USA Net Worth Percentiles Matter for Your Future?

- Steps Towards Improving Your USA Net Worth Percentiles

- What Influences Your Spot in the USA Net Worth Percentiles?

- Looking Ahead at USA Net Worth Percentiles

What Does Net Worth Even Mean?

When we talk about someone's net worth, we are essentially looking at a snapshot of their financial situation at a particular moment. It is a simple calculation, really, even though it sounds rather official. You add up everything a person owns that has some sort of monetary value. This might include things like money in a bank account, investments in stocks or bonds, real estate such as a house or land, and even items that hold considerable value, like a car or precious belongings. That is the 'assets' part of the equation, as a matter of fact.

Then, from that total sum of assets, you subtract everything a person owes. This includes things like a mortgage on their home, student loans that need paying back, credit card balances, or any other kind of debt they might have. The result of this subtraction is what we call net worth. It is, in a way, the true measure of a person's financial standing, showing how much wealth they have truly built up over time. It is a pretty clear picture, you know, of what is left after all the bills are considered.

A positive net worth means that a person's assets are greater than their debts, which is generally a good sign of financial health. On the other hand, if someone has a negative net worth, it means their debts are more than what they own. This can happen for various reasons, especially earlier in life when people are perhaps taking on student loans or a mortgage to buy a first home. So, it is not always a bad thing to start with, but it is certainly something to keep an eye on.

Understanding Your Place in USA Net Worth Percentiles

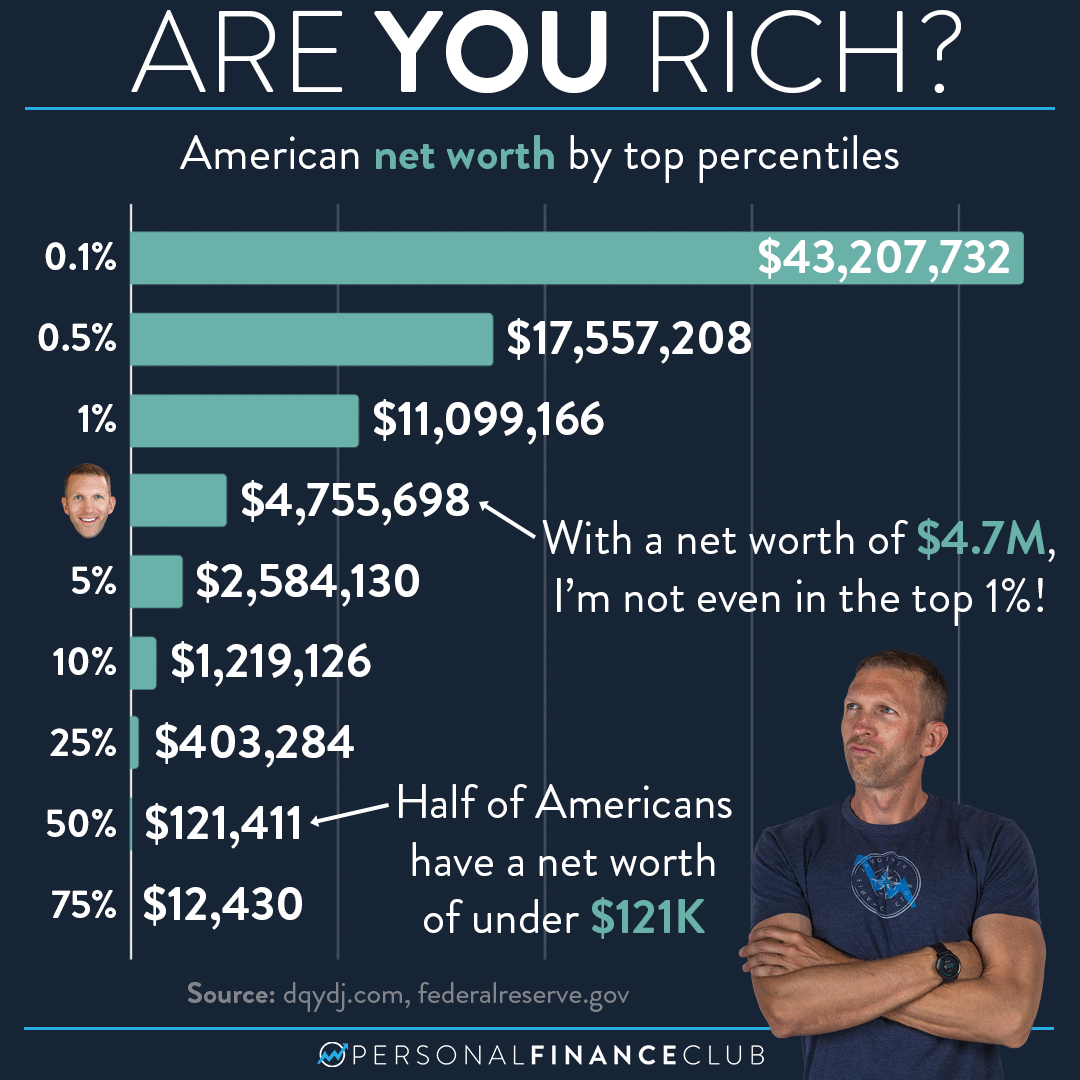

Now, when we add the word "percentiles" to "net worth," we are talking about how your financial situation compares to everyone else's. Imagine lining up all the households in the USA from the one with the lowest net worth to the one with the highest. A percentile tells you what percentage of those households you are doing better than. For example, if your net worth puts you in the 75th percentile, it means you have more wealth than 75 percent of the other households in the country. This is quite a helpful way to see how you measure up.

These USA net worth percentiles give us a broader view of financial distribution across the nation. They show us where the bulk of the population sits, and also highlight the extremes, both at the very top and the very bottom of the financial spectrum. It is a bit like looking at a financial map of the country, where you can see the different elevations of wealth. This kind of information helps economists and regular folks get a sense of how wealth is spread out, or concentrated, among the people living here.

Knowing where you stand in these USA net worth percentiles can be quite motivating for some people. It might encourage them to save more, invest more wisely, or think about ways to reduce what they owe. For others, it might offer a sense of reassurance about their progress. It is not about judging, but rather about gaining some perspective on your financial journey within the larger context of the country's economy.

How Do We Measure Financial Well-being in the USA?

Measuring how financially well-off people are in the USA is a complex task, but it is one that various organizations take on regularly. The Federal Reserve, for instance, conducts surveys to gather information about household finances. They look at things like income, assets, and debts across different groups of people. This data helps them figure out the typical net worth for various age brackets, education levels, and other demographic details. It gives us a pretty comprehensive picture, you know.

These surveys are crucial because they help us understand the broader financial health of the nation. They show us patterns, like how net worth tends to grow as people get older, or how educational attainment can often influence someone's financial standing. It is not just about raw numbers; it is about seeing the stories those numbers tell about people's lives and their financial journeys. Without this kind of detailed information, it would be very hard to get a real sense of how things are progressing.

Other indicators, such as consumer spending habits, savings rates, and even the types of investments people make, also contribute to this overall picture of financial well-being. It is a bit like putting together a large puzzle, with each piece adding to our overall grasp of how financially stable or prosperous the general population is. These measurements help shape policies and give individuals a benchmark for their own planning, too it's almost.

Different Age Groups and USA Net Worth Percentiles

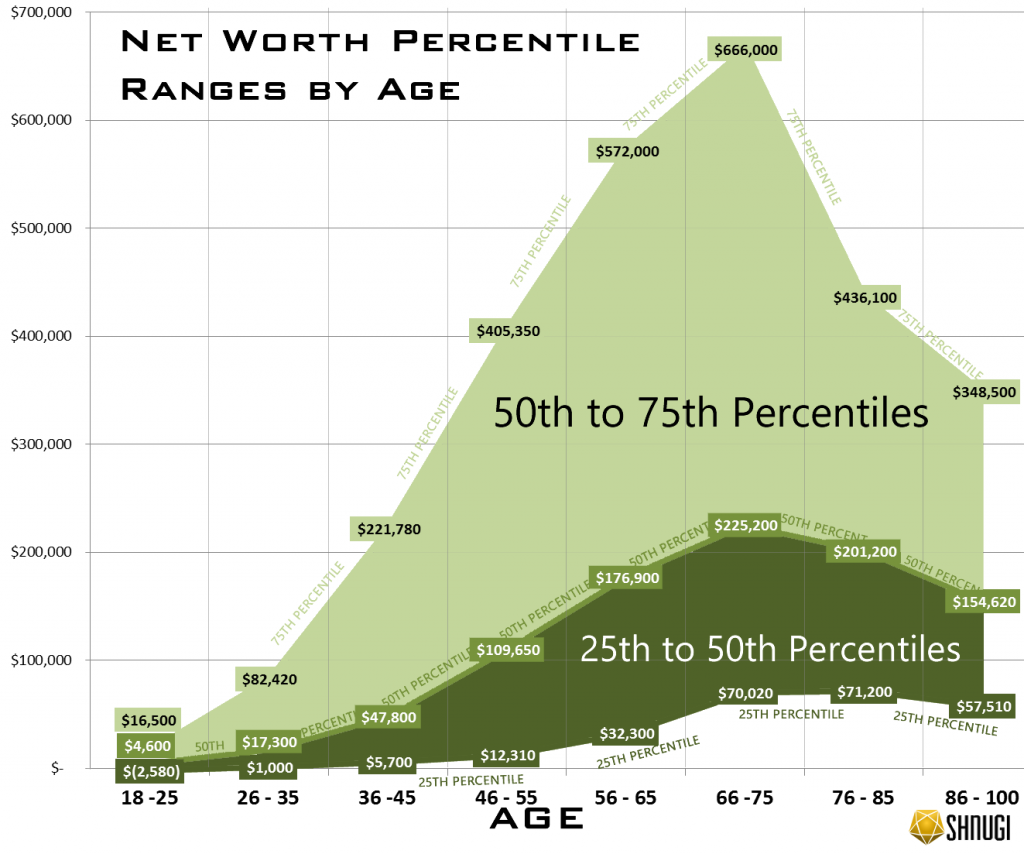

It is pretty common to see that net worth tends to change quite a bit as people move through different stages of their lives. For younger adults, perhaps those in their twenties or early thirties, it is not unusual for their net worth to be on the lower side, or even negative. This is because many are just starting their careers, possibly paying off student loans, and maybe even taking on a mortgage for their first home. So, they are building up assets but also accumulating debts, in some respects.

As people get older, say into their forties and fifties, their net worth typically starts to grow more substantially. They have had more time to pay down debts, save for retirement, and perhaps see their investments increase in value. This is often the period when people are earning their highest incomes and are more focused on building long-term wealth. The USA net worth percentiles for these age groups tend to show a noticeable climb.

For those nearing or in retirement, often in their sixties and beyond, net worth might reach its peak. At this point, many have paid off their homes, their children are grown, and their retirement savings have had decades to accumulate. However, it is also a time when people might start drawing down on their assets, so the trend can vary. Understanding these age-related patterns within the USA net worth percentiles helps people set realistic goals for their own financial future, too.

Why Do USA Net Worth Percentiles Matter for Your Future?

Thinking about where you stand in the USA net worth percentiles can be more than just a matter of curiosity; it can actually be quite helpful for planning your future. When you have a sense of what the average or typical net worth looks like for people in your age group or with similar circumstances, it gives you a benchmark. It is not about comparing yourself negatively to others, but rather about having a realistic idea of what is achievable and what steps you might need to take to reach your own financial goals.

For example, if you find that your net worth is lower than what you would like, it might prompt you to make some changes. This could mean looking for ways to save more money, perhaps by cutting back on certain expenses, or exploring different investment options. It might also encourage you to think about increasing your income, maybe through further education or career advancement. These percentiles, you know, can serve as a gentle nudge.

On the other hand, if you are doing quite well compared to the USA net worth percentiles, it might give you a sense of confidence and validate your financial choices. It could also lead you to consider new opportunities, like early retirement or philanthropic endeavors. Ultimately, understanding these figures helps you make informed decisions about your money and what you want to achieve down the road. It is a way of taking control of your financial story, basically.

Steps Towards Improving Your USA Net Worth Percentiles

If you are looking to improve your position within the USA net worth percentiles, there are several practical steps you can consider. One of the most fundamental is to consistently save a portion of your income. Even small amounts put away regularly can add up significantly over time, especially when you factor in things like investment growth. It is about building a habit of putting money aside, which is a very powerful thing.

Another important step is to manage your debts wisely. High-interest debts, like credit card balances, can really eat into your financial progress. Focusing on paying these down can free up more money for saving and investing, thus boosting your net worth. It is a bit like removing a heavy weight that is holding you back, you know. Reducing what you owe is just as important as increasing what you own.

Investing is also a key component for many people looking to grow their wealth. This could involve putting money into retirement accounts, like a 401(k) or an IRA, or investing in the stock market. The goal is to have your money work for you, potentially earning returns that help your assets grow faster than just saving alone. And, of course, continuing to learn and develop new skills can lead to higher earning potential, which in turn gives you more money to save and invest, positively affecting your USA net worth percentiles.

What Influences Your Spot in the USA Net Worth Percentiles?

Many different things play a part in determining where someone lands in the USA net worth percentiles. Your age, as we touched on, is a big one. Generally, the longer you have been working and saving, the more time your wealth has had to accumulate. Education also tends to have a notable impact; those with higher levels of schooling often have access to jobs with better pay, which can lead to more opportunities for saving and investing.

Your career path and industry can also make a difference. Some professions simply pay more than others, creating a higher earning potential. Where you live within the USA can also play a role, as the cost of living varies significantly from one area to another. Living in a place with a very high cost of housing, for example, might mean you have less money left over to save, even if your income is substantial.

Life choices, like whether you get married, have children, or incur significant medical expenses, can also shape your financial journey. Unexpected events, such as job loss or unforeseen health issues, can also impact net worth. So, while individual effort matters a lot, there are also broader economic and personal circumstances that contribute to where people find themselves within the USA net worth percentiles. It is a very complex picture, really.

Looking Ahead at USA Net Worth Percentiles

As the economy of the USA continues to change, so too will the landscape of net worth percentiles. Factors like inflation, interest rates, and the performance of different industries all play a part in how wealth is created and distributed across the country. It is a dynamic situation, and what might be considered a high net worth today could shift in the future. Keeping an eye on these broader economic trends is something many people do.

Technological advancements and shifts in the global economy also have an effect on how people earn money and build wealth. New opportunities arise, and some older industries might decline, which can impact the financial standing of many households. The way people save and invest also evolves, with new financial products and strategies becoming available. All of this influences the overall picture of USA net worth percentiles.

For individuals, the key remains consistent: focusing on smart financial habits, adapting to economic changes, and continuously working towards their personal financial goals. While the exact numbers and where you stand in the USA net worth percentiles might change over time, the principles of saving, managing debt, and investing wisely continue to be important for building a secure financial future. It is a pretty straightforward approach, in a way.

This article has explored the concept of net worth, what percentiles mean in a financial context, and how these apply to the USA. We have discussed how financial well-being is measured, looked at how net worth changes across different age groups, and considered why understanding these percentiles can be helpful for personal financial planning. We also touched upon the various influences on an individual's net worth and thought about how the financial landscape might evolve.

Net Worth Percentile 2025 United States - Zoe Rees

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

/images/2021/08/18/8a4d4aec-de97-4f84-8cd1-fbebe0b93ae4.png)

U.S. Net Worth Statistics: The State of Wealth in 2024 | FinanceBuzz