Average Net Worth In The World - A Simple Look

Many people wonder about their financial standing compared to others, especially when they hear talk of wealth. It's a natural thing to think about, really. We often look for ways to see where we fit in, and for money matters, that might mean asking about the typical amount of wealth people hold. This idea of an "average net worth" comes up quite a bit.

Figuring out what a typical amount of wealth looks like for people across the globe is a bit like trying to measure the flow of a very wide river, you know. There are so many streams feeding into it, and some parts move faster than others. It's not just a single number; it's a way of looking at what folks own versus what they owe, and then seeing what that looks like for many individuals, everywhere.

This kind of financial picture, the average net worth in the world, can give us some general ideas, but it's important to remember it doesn't tell each person's whole story. It's more of a general guide, like knowing the typical rainfall in a region. It helps us see broad patterns, even if one day is sunny and the next is quite wet.

Table of Contents

- What Does "Average Net Worth" Truly Mean?

- How Is the Average Net Worth in the World Figured Out?

- Factors Shaping Your Financial Picture

- How Age Plays a Part in Average Net Worth in the World?

- Looking at the Bigger Picture of Global Wealth

- Why Do Averages for Net Worth in the World Vary So Much?

- Beyond the Numbers - What Matters Most

- Steps to Build Your Financial Standing

What Does "Average Net Worth" Truly Mean?

When people talk about "net worth," they are, in a way, just talking about what someone owns minus what they owe. Think of it like this: if you have a house, a car, and some money in a savings account, those are things you own. If you have a mortgage on your house or a loan for your car, those are things you owe. Your net worth is the difference between these two figures. It's a simple calculation, really, but it gives a quick snapshot of someone's financial health. When we consider the "average net worth in the world," we are looking at this calculation for a great many people and then finding a typical figure from all those individual sums. It's a way of trying to get a sense of the general financial well-being of people across the globe, you know, just a general idea.

This average figure can be a bit deceiving, though. For example, if you have a few very wealthy people and many people with very little, the average might look higher than what most people actually have. It's like having a class where one student is very tall and everyone else is of average height; the average height of the class might seem taller than what most students are. So, when we look at the average net worth in the world, it's good to keep in mind that it's just one way of seeing things, and it doesn't always show the full picture of how wealth is spread out among people. It's a number that gives us a starting point for discussion, more or less, but not the complete story.

Understanding this number means seeing it as a broad measure. It helps us to discuss overall economic situations, and perhaps where wealth tends to collect. It's a way to talk about the general state of things financially, without getting too caught up in individual situations. The typical person's net worth might be quite different from the reported average, especially when a few individuals hold a great deal of the world's money. This is something to consider when you hear about the average net worth in the world, as a matter of fact. It's a statistic that needs a little more thought.

How Is the Average Net Worth in the World Figured Out?

Figuring out the average net worth in the world is a big task, to be honest. It involves collecting information from many different countries and many different people. Researchers and financial groups gather details about what people own – like homes, cars, investments, and savings accounts – and then they look at what people owe, such as mortgages, student loans, and credit card balances. These figures are then added up and averaged out. It's a process that tries to capture a very wide range of financial situations, from those with a lot to those with very little. This kind of work helps us get a sense of the typical financial standing globally, you know, a sort of general pulse.

The numbers used to figure this out often come from official reports, surveys, and economic studies. It's not a simple headcount, but rather a careful look at a lot of financial data. For example, similar to how a doctor might look at several blood pressure readings over time to get a good picture of someone's health, financial experts look at various financial figures to get a sense of a country's or the world's financial well-being. They might use things like household surveys, national income accounts, and balance sheets from different places. This helps to paint a picture, though it's never a perfectly sharp one, you know.

It's important to know that different groups might use slightly different ways to gather and put together this information, which means the exact average net worth in the world figure can vary a little depending on who is reporting it. Some reports might focus more on certain types of assets or might not include all kinds of debts. This is why you might see slightly different numbers from various sources. But the general idea remains the same: it's an attempt to show a typical financial situation by balancing what people possess against what they are obligated to pay back. It's a way to get a broad sense of things, basically, rather than a precise personal figure.

Factors Shaping Your Financial Picture

Many things play a part in shaping someone's financial picture, and by extension, the average net worth in the world. It's not just about how much money you make; it's also about how you use that money, where you live, and even what kind of work you do. For example, people living in countries with higher living costs might need more money just to cover their basic needs, which can affect how much they can save or invest. Similarly, someone working in a field that pays very well might build wealth faster than someone in a field with lower pay. It's a complex mix of personal choices and outside influences, really.

Things like how much you save, what you invest in, and how much debt you take on all make a difference. If someone consistently puts money away and makes smart choices about where to put it, their wealth tends to grow over time. On the other hand, if someone has a lot of debt, it can eat into their financial resources and make it harder to build up what they own. It's a bit like trying to keep a bucket full; if you have a lot of holes in it, the water drains out faster, you know. So, personal habits around money are quite important in this whole picture, too.

Outside of personal actions, broader economic conditions also have a big say. When a country's economy is doing well, there might be more job opportunities, better pay, and more chances for investments to grow. When the economy is struggling, the opposite can happen. Things like inflation, interest rates, and even global events can influence everyone's financial standing. So, while individual choices matter a lot, the bigger economic environment plays a significant part in shaping someone's financial reality, and therefore, the overall average net worth in the world. It's a combination of many things, actually.

How Age Plays a Part in Average Net Worth in the World?

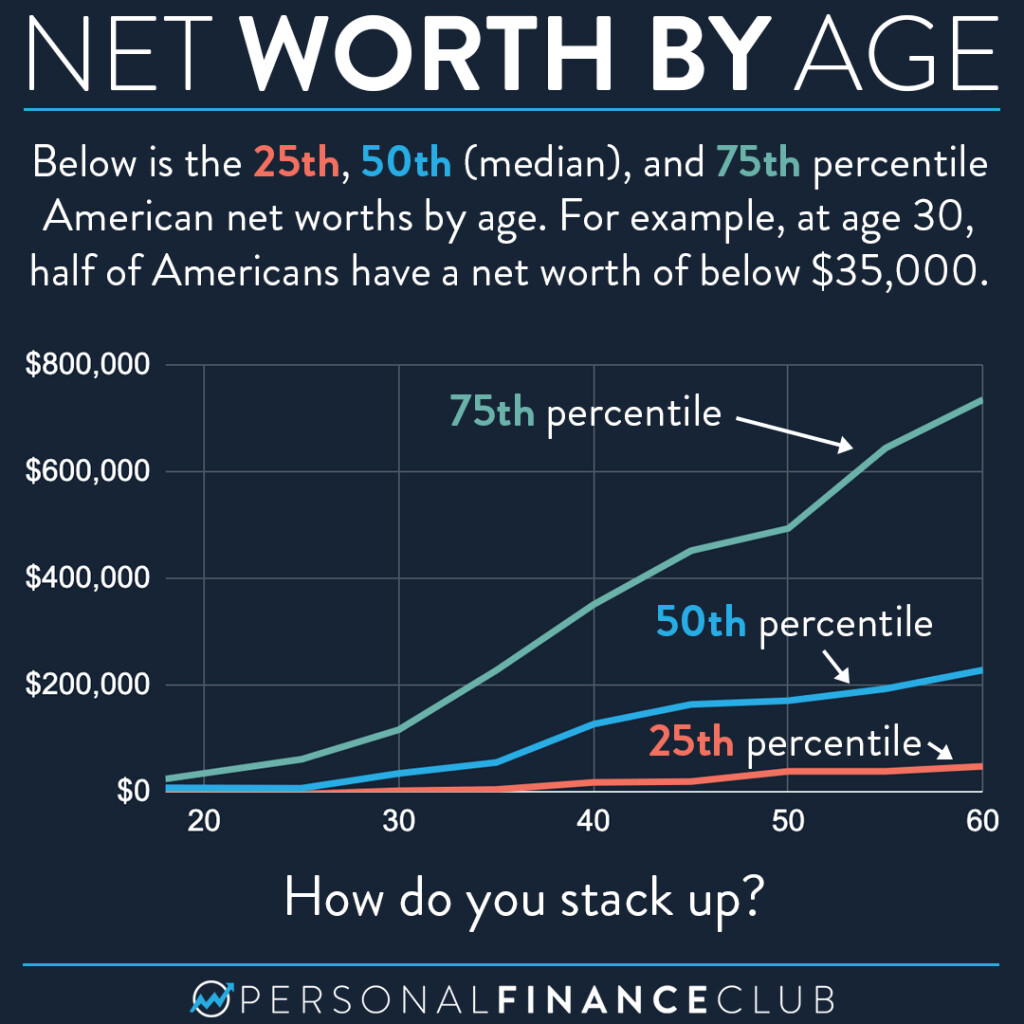

Age often plays a clear part in how someone's financial standing develops, and this also influences the average net worth in the world. When people are younger, they might just be starting their careers, perhaps paying off student loans, or saving for a first home. At this stage, their net worth might be lower, or even negative if they have a lot of debt. It's a time of building, you know, putting the foundations in place. They might not have had as much time to accumulate assets or see their investments grow. This is pretty typical for people in their twenties and early thirties, so.

As people get older, say into their forties and fifties, they often reach their peak earning years. They might have paid off some debts, like a mortgage, and have had more time to save and invest. Their careers might be more settled, offering a chance to put more money aside. This is when many people see their net worth grow more quickly. It's a period where they might be planning for retirement, so building up their financial reserves becomes a main focus. This pattern is fairly common across many different places, you know.

Later in life, in retirement, people might start using the money they saved. Their net worth could begin to decrease as they draw from their investments for living expenses. However, they might also have significant assets like a fully paid-off home. So, while the average net worth in the world does show a general trend of increasing with age up to a point, and then possibly declining, it's not a strict rule for everyone. Some people might start saving later, or have different life events that change their financial path. It's a general observation, more or less, rather than a hard and fast rule.

Looking at the Bigger Picture of Global Wealth

When we consider the average net worth in the world, we are really looking at a very broad picture of wealth across all countries and all kinds of people. This bigger view helps us see how wealth is distributed, not just among individuals, but also between different nations. Some countries, for example, have a long history of economic growth and stable financial systems, which means their citizens might, on average, have more wealth. Other countries might be still developing, or have faced economic challenges, leading to lower average wealth among their people. It's a way to see the global economic landscape, in a way.

This global view also brings up the idea of wealth differences between different parts of the world. There are often big gaps between the wealth of people in very developed countries and those in less developed ones. These differences can be due to many things, like access to education, types of jobs available, political stability, and even historical events. So, while we talk about an "average net worth in the world," it's crucial to remember that this number is made up of wildly different individual and national financial situations. It's a statistic that covers a very wide range, you know.

Understanding this bigger picture helps us to see the challenges and opportunities in different places. It shows where there might be a need for economic support or development. It also highlights how interconnected the world's economies are. What happens in one part of the globe can, in some respects, affect the financial standing of people elsewhere. So, looking at the average net worth in the world is more than just a number; it's a way to begin discussions about global economic fairness and growth. It gives us a broad stroke view of how wealth is shared, or not shared, across the planet, really.

Why Do Averages for Net Worth in the World Vary So Much?

The reasons why the averages for net worth in the world vary so much are quite numerous, to be honest. One big reason is the difference in economic conditions from one country to another. Some nations have strong economies with many opportunities for people to earn good incomes and save money. They might have well-developed financial markets where investments can grow. Other nations might have weaker economies, with fewer jobs, lower pay, and less chance for people to build up savings. This directly affects how much wealth people can gather, you know.

Another key factor is the level of debt that people carry. In some places, it's common for people to take on large mortgages or student loans, which can reduce their net worth, at least temporarily. In other places, debt might be less common, or people might pay it off more quickly. Government policies also play a part; things like taxes, social support programs, and regulations around property ownership can all influence how much wealth individuals can hold. So, a person's net worth is not just about their personal choices, but also about the system they live within, you know.

Cultural attitudes towards saving and spending also matter, in a way. In some cultures, there's a strong emphasis on saving money for the future and passing wealth down through families. In others, spending might be more common. Natural resources, political stability, and even the history of a region can also contribute to these differences. All these elements combine to create a very varied picture of wealth across the globe, making the average net worth in the world a figure that hides a lot of different stories. It's a truly complex set of influences, actually.

Beyond the Numbers - What Matters Most

While looking at the average net worth in the world can be interesting, it's important to remember that these numbers don't tell the whole story of someone's life or their well-being. A high net worth doesn't always mean happiness, and a lower one doesn't mean a lack of a good life. Things like personal health, strong relationships with family and friends, a sense of purpose, and access to good education or healthcare often matter more for overall life satisfaction than just a financial figure. These are the things that truly enrich a person's existence, you know.

Focusing too much on a single number, like net worth, can sometimes make people feel like they are falling short, even if they are doing quite well in other parts of their lives. It's a bit like looking at someone's weight and thinking you know everything about their health, when in fact, many other things, like diet and exercise habits, are just as important. Financial numbers are just one piece of a much larger puzzle that makes up a person's life. It's really about balance, in some respects.

What truly matters is often how someone feels about their own financial situation, and whether they have enough to meet their needs and pursue their goals. Having a sense of financial security, being able to handle unexpected costs, and having some freedom to make choices are often more valuable than simply having a very large number in a bank account. So, while the average net worth in the world gives us a general idea of global wealth, it's always good to remember that personal well-being goes far beyond just money. It's about a much broader sense of richness, actually.

Steps to Build Your Financial Standing

Building your financial standing, no matter what the average net worth in the world suggests, often comes down to some straightforward steps. One important step is to understand where your money goes. Keeping track of your spending helps you see where you might be able to save a little more. It's like checking your blood sugar regularly if you have diabetes; it gives you the information you need to make good choices. Knowing your habits is a very good start, you know.

Another step is to create a plan for your money. This could mean setting aside a certain amount each month for savings, or putting money towards paying off debts. Having a clear goal can make it easier to stick to your plan. It's like knowing how much fluid your body needs each day; once you know the amount, you can work towards reaching it. A simple plan, even a basic one, can make a real difference over time, too.

Looking for ways to make your money work harder is also helpful. This might involve learning about different types of savings accounts or simple investments. Even small amounts put away consistently can grow over the years, thanks to the way money can earn more money. And, of course, keeping an eye on any debts you have and working to reduce them can free up more of your income for savings. It's about being aware and making choices that support your financial well-being, you know, just like understanding how aging affects your body. Small, consistent actions tend to build up over time.

Net worth of the average family in OECD countries around the world

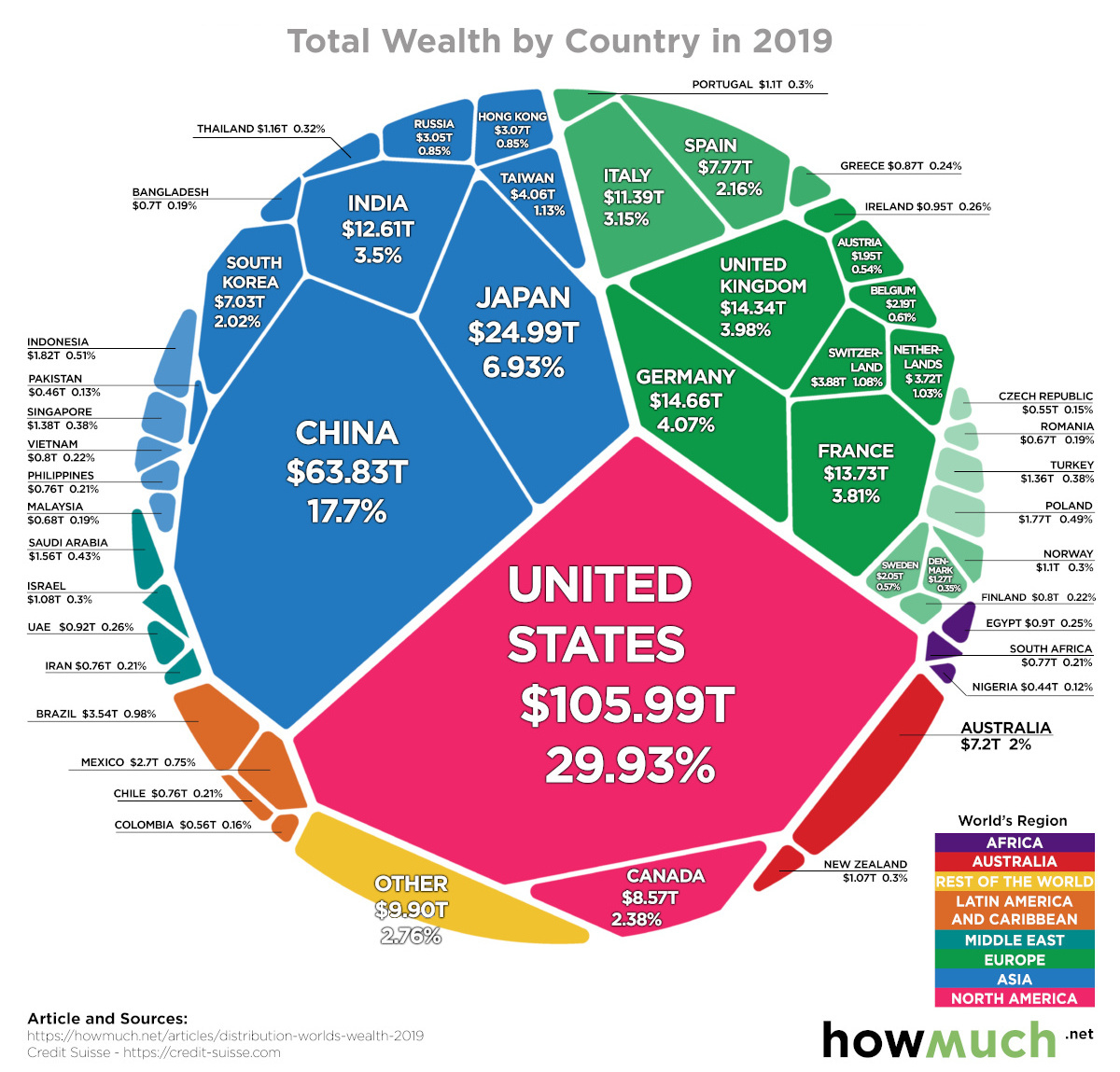

Chart: All of the World's Wealth in One Visualization

What is the median net worth by age? - Blog Posts - Personal Finance Club