US Net Worth By Percentile - Understanding Financial Standing

Thinking about how wealth is spread out among people in a big country like the United States can be quite interesting, even a little thought-provoking. It helps us get a sense of where different households stand financially, giving us a clearer picture of money matters across the land. This kind of information, you know, about who has what, really shows us the different economic experiences people have. It is that sort of data which helps many people see the broader financial picture.

When we look at things like "us net worth by percentile," we are essentially trying to figure out the financial picture. It is a way of seeing how many assets people own, minus their debts, and then ranking everyone from the least to the most. This way of looking at things helps us grasp the spread of financial holdings, giving us a view of the economic situation for many families and individuals. It really offers a way to talk about economic well-being.

Knowing about these percentiles offers a peek into the economic health of a nation. It is not just about big numbers; it is about the everyday lives of people, their savings, their homes, and their financial futures. This kind of information, so, helps us understand the broader story of how people are doing financially, and what that might mean for everyone involved. It gives a sense of the financial realities for many folks.

Table of Contents

- Understanding Financial Footing in the US

- What is Net Worth, Anyway?

- Why Do Percentiles Matter for US Net Worth?

- How Do We Measure Financial Standing?

- The Big Picture of US Net Worth Distribution

- Are There Different Ways to View US Net Worth?

- Factors Influencing US Net Worth Positions

- The Impact of Financial Planning on US Net Worth

Understanding Financial Footing in the US

Figuring out the financial standing of people across a large country like the United States means looking at more than just simple averages. Averages, you know, can sometimes hide the true picture, making things seem more even than they really are. When we talk about "us net worth by percentile," we are getting into a way of seeing how financial resources are actually spread out among all the households. It is a bit like mapping out the various financial paths people take, from those just starting out to those who have built up quite a bit of financial strength. This approach helps us get a clearer idea of the different economic situations people find themselves in, which is pretty important for a complete view.

Consider, if you will, the idea of financial well-being for a whole nation. It is a complex thing, made up of countless individual stories of saving, spending, and investing. Looking at percentiles allows us to group these stories, giving us categories that show where different groups of people stand. It helps us see the spread, from those with fewer assets to those with a great deal more. This perspective, you see, offers a more nuanced look at the economic condition of families and individuals across the country, painting a more honest picture of financial realities.

The overall picture of financial strength in the US, when viewed through percentiles, can be quite telling. It is about recognizing that not everyone is on the same footing, and that is just a fact of life. This way of looking at things helps us appreciate the diverse financial journeys people experience. It is a way of understanding the financial health of the nation, one household at a time, but also in broad strokes. So, when we talk about "us net worth by percentile," we are really talking about getting a handle on the various financial situations that exist within the country's borders.

What is Net Worth, Anyway?

So, what exactly do people mean when they talk about "net worth"? It is a rather simple idea, really, at its core. Your net worth is basically what you own minus what you owe. Think of it like this: you add up everything you have that holds value – your home, any savings accounts, investments, cars, even valuable possessions. These are your assets. Then, you take away all the money you need to pay back – things like mortgages, student loans, credit card balances, or car payments. These are your liabilities, or debts. The number you are left with is your net worth. It is a pretty straightforward calculation, actually, that gives you a snapshot of your financial standing at a particular moment.

It is important to remember that net worth is not just about how much money you have in the bank right now. It is a broader measure of your financial health, encompassing all sorts of things that contribute to your financial picture. For instance, a house might be a big asset for many families, while a large student loan could be a significant liability. The balance between these two sides, the things you possess and the money you are obligated to return, gives you that key figure. This figure, you know, can change quite a bit over time as people buy things, pay off debts, or see their investments grow or shrink. It is a dynamic measure, in some respects, reflecting ongoing financial choices and market conditions.

When we apply this idea to "us net worth by percentile," we are taking this simple calculation and applying it to millions of households across the nation. Each family has its own collection of assets and its own set of debts. By gathering all this information and then performing that simple subtraction, we get an individual net worth for each household. Then, these individual figures are lined up from the lowest to the highest to create those percentiles. It is a very practical way to get a handle on the financial realities of a very large group of people, offering a clear measure of collective financial standing.

Why Do Percentiles Matter for US Net Worth?

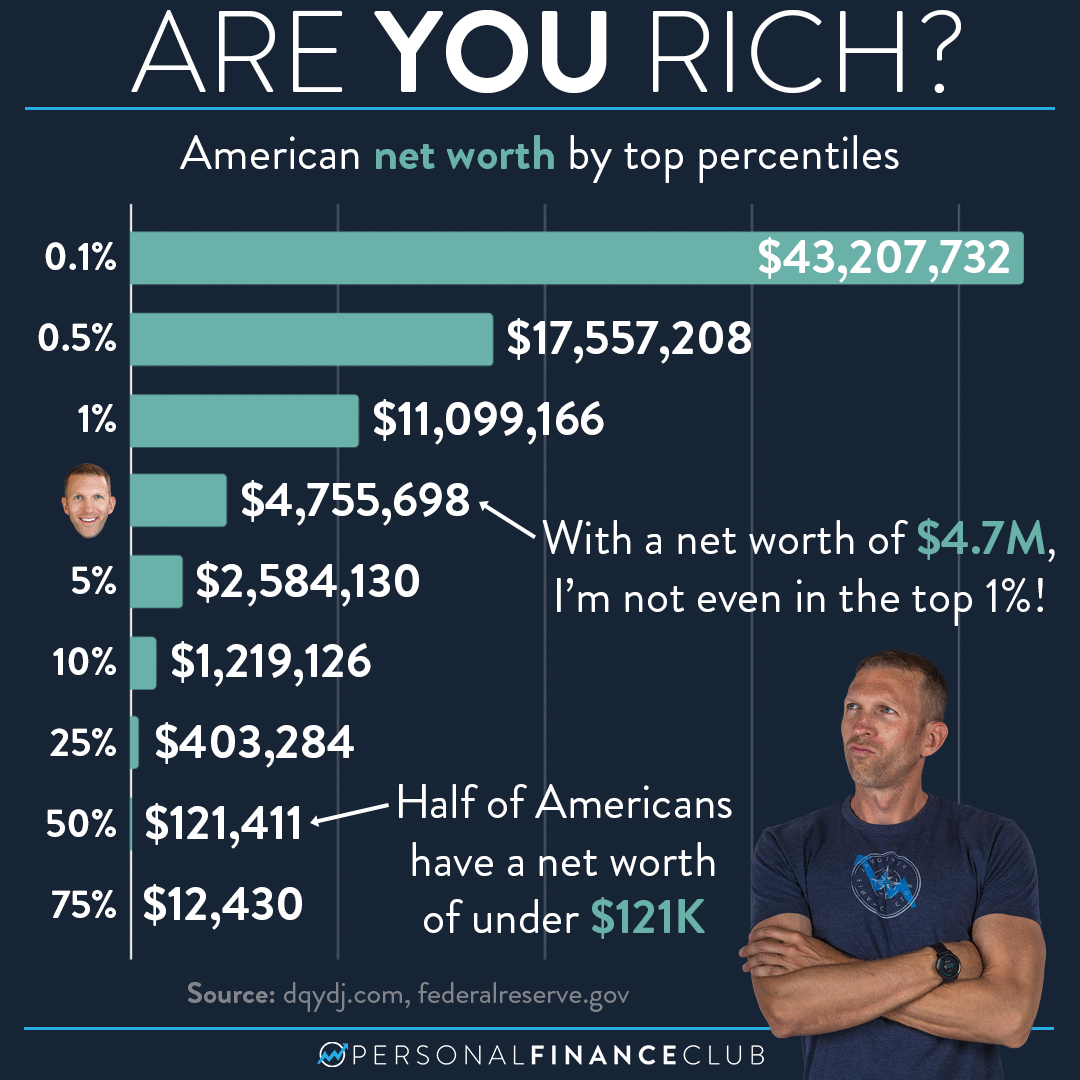

You might wonder why we bother with percentiles when looking at something like "us net worth." Why not just use an average, right? Well, averages can be a bit deceiving, especially when there is a wide range of values. Imagine a street where most people have modest homes, but one person has a huge mansion. If you just take the average home value on that street, the mansion owner's wealth would pull that average up, making it seem like everyone on the street is doing better than they actually are. Percentiles, on the other hand, give us a much clearer and more honest view of the spread.

When we talk about percentiles, we are essentially dividing the population into groups based on their net worth. For example, the 50th percentile means that half of the households have a net worth at or below that figure, and half have a net worth at or above it. This gives us a much better sense of what the typical household's financial situation looks like, as opposed to an average that could be skewed by a few very wealthy individuals. It is a way of seeing the distribution, which is pretty important for understanding the economic picture for most people.

This approach is especially helpful for understanding "us net worth by percentile" because a country as large and diverse as the United States naturally has a wide spectrum of financial situations. Using percentiles allows us to see the financial conditions of different segments of the population, from those with very little accumulated wealth to those with substantial financial holdings. It helps to show where the majority of people fall, and also highlights the differences that exist. This way, we get a much more complete and accurate picture of financial well-being across the nation, which is quite useful for many kinds of discussions.

How Do We Measure Financial Standing?

When people talk about measuring financial standing, especially for something as broad as "us net worth by percentile," they are usually thinking about a few key elements. It starts, as we discussed, with figuring out what someone owns. This includes things that are easy to put a value on, like money in a bank account or investments in stocks and bonds. But it also includes bigger things, like the value of a home or other real estate. These are all considered assets, and they are pretty important for building up financial strength. The way these things are counted, so, helps form the basis of the net worth calculation.

On the other side of the ledger are the things people owe. This means all the various types of debt that can weigh on a household's financial picture. Mortgages, for example, are a big one for many homeowners. Then there are other common debts, like car loans, personal loans, or credit card balances. Student loans, too, can be a significant part of what many individuals owe, especially younger people. All these liabilities get subtracted from the assets to arrive at that net worth figure. It is a rather clear way of seeing the complete financial picture for a household, taking into account both the good and the bad.

The actual gathering of this information for a national measure like "us net worth by percentile" often involves large surveys and data collection efforts. Government agencies or research groups will collect information from many different households, asking about their various assets and debts. This data is then put together, allowing researchers to see patterns and distributions across the population. It is a very systematic way to get a handle on the financial realities for a vast number of people, giving us a general sense of how financial well-being is spread out across the country.

The Big Picture of US Net Worth Distribution

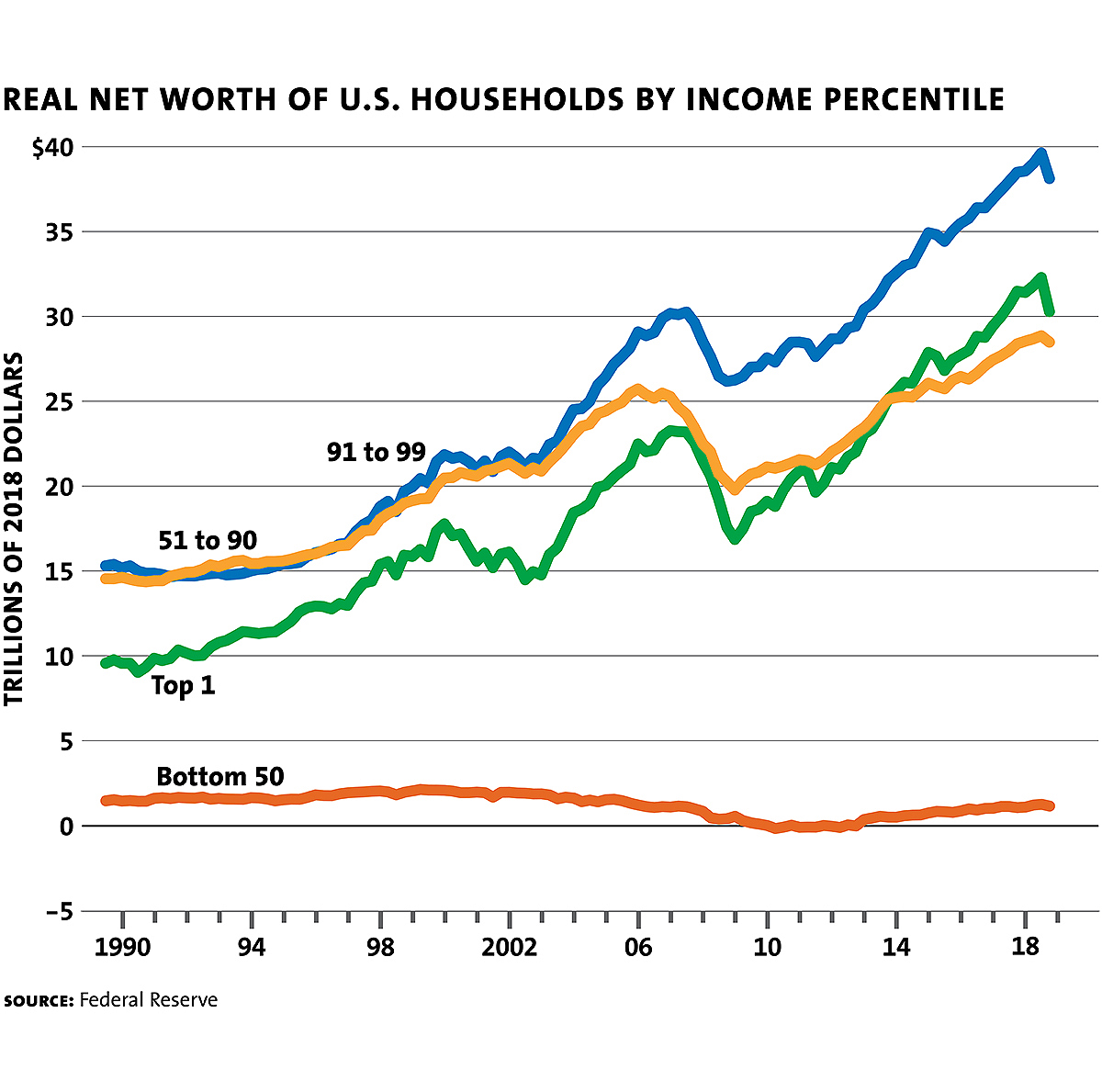

Looking at the overall picture of "us net worth by percentile" shows us that financial resources are not spread out evenly. This is a common pattern in many countries, and the United States is no different. You typically see that a smaller portion of the population holds a larger share of the total wealth, while a larger portion of the population holds a smaller share. It is just the way things tend to be, reflecting many different economic forces and individual circumstances. This kind of distribution is often shown with those percentile groupings, making it easier to see where different groups stand.

For instance, when people talk about the "median" net worth, they are referring to the 50th percentile. This figure represents the financial standing of the household right in the middle of the line, if you were to rank everyone from lowest to highest. It is a pretty good indicator of what the typical family's financial situation looks like. Then, as you move up the percentiles, you see the net worth figures get progressively larger, especially as you approach the very top. This illustrates the varying levels of financial accumulation across the population, which is quite informative.

Understanding this broad distribution is important for many reasons. It helps people see the different financial realities that exist within the country. It also helps in discussions about economic well-being and opportunity. The story of "us net worth by percentile" is, in a way, a story about the diverse financial experiences of millions of people living in one big country. It is a picture that shows the range of financial situations, from those with very little to those with a great deal, giving us a more complete view of the nation's financial landscape.

Are There Different Ways to View US Net Worth?

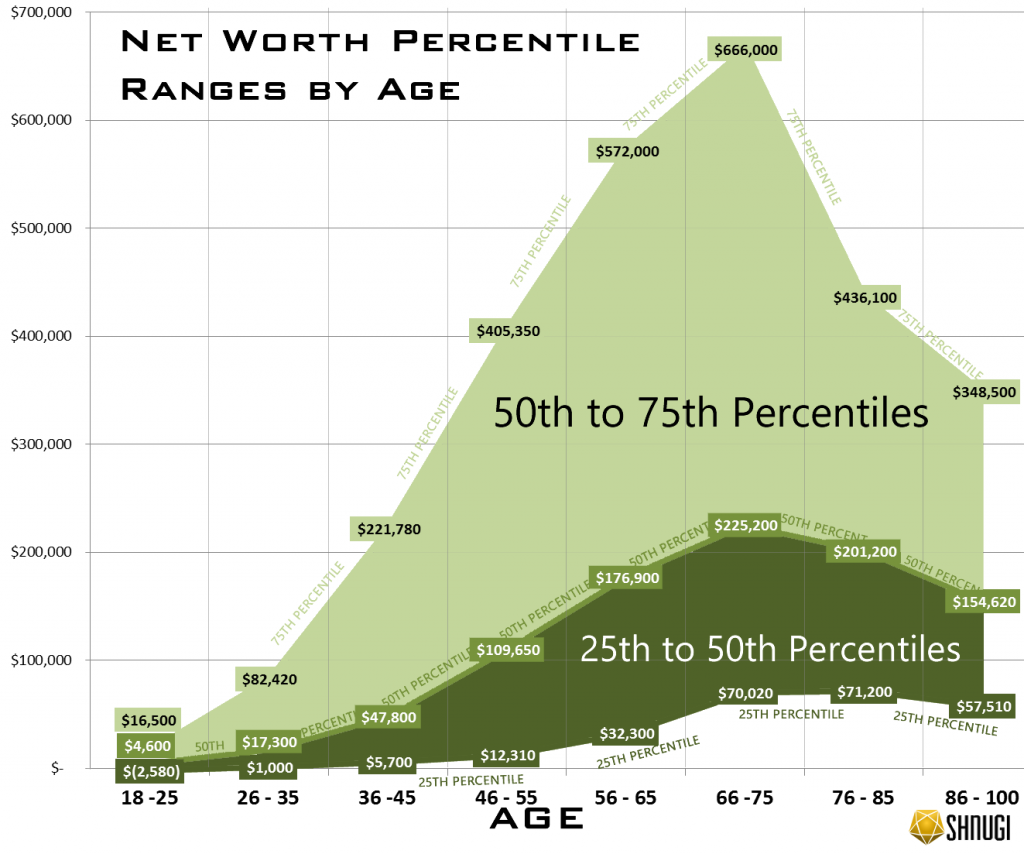

When we talk about "us net worth by percentile," it is not just one simple number for everyone. There are, in fact, many different ways to slice and dice this information, giving us a more detailed look at financial standing across different groups. For example, a person's age can play a pretty big role in their net worth. Younger people are often just starting out, perhaps with student loans and little accumulated wealth, while older individuals have had more time to save, invest, and pay off debts. So, if you look at net worth by age group, you will see some pretty clear patterns, reflecting different life stages.

Beyond age, other factors also influence where a household might fall in the "us net worth by percentile" rankings. Things like education level can often correlate with earning potential, which in turn can affect how much wealth a person accumulates over their lifetime. Where someone lives, too, can play a part; housing costs and job opportunities vary greatly across different parts of the country, influencing both assets and liabilities. These various demographic and geographic elements help paint a more nuanced picture of financial distribution.

It is also possible to look at net worth by household type, or by the kind of work people do. All these different lenses help us understand the complexities behind the overall "us net worth by percentile" figures. They show us that financial standing is influenced by a whole host of factors, from personal choices to broader economic conditions and life circumstances. This multi-faceted view gives us a richer appreciation for the diverse financial stories that make up the overall economic fabric of the nation.

Factors Influencing US Net Worth Positions

Many things can influence where a household ends up in the "us net worth by percentile" rankings. One very important element is income. Generally speaking, households with higher incomes have more capacity to save and invest, which over time, helps them build up their assets and reduce their debts. It is pretty straightforward, actually, that having more money coming in makes it easier to set some aside for the future and pay off what you owe. This steady accumulation often translates into a higher net worth.

Another big factor is the presence of debt. Carrying a lot of debt, especially high-interest debt like credit card balances, can really hold back a household's net worth. Even if a household has decent assets, if their liabilities are also very high, their net worth will be lower. Managing debt effectively, paying it down, and avoiding unnecessary borrowing are all pretty important steps for improving one's financial standing. It is a balance, you see, between accumulating assets and keeping liabilities in check.

Life events also play a considerable role. Things like buying a first home, starting a family, or going through a period of unemployment can all significantly impact a household's net worth. Major health events, too, can sometimes lead to unexpected expenses that affect financial stability. These are the kinds of real-life situations that shape individual financial journeys and, by extension, contribute to the overall picture of "us net worth by percentile." It is a dynamic process, where personal choices and external circumstances both play their part.

The Impact of Financial Planning on US Net Worth

When it comes to a household's position within the "us net worth by percentile," personal financial planning can make a genuine difference. While larger economic forces certainly play a role, the choices individuals and families make about their money have a very real impact. Things like creating a budget, regularly putting money into savings, and making thoughtful investment decisions can all contribute to building up assets over time. It is about being deliberate with your money, rather than just letting it happen, which is pretty powerful.

Saving for the future, for instance, is a key part of increasing net worth. Whether it is putting money into a retirement account, building an emergency fund, or saving for a down payment on a house, these actions directly boost the asset side of the net worth equation. Similarly, being smart about debt – like paying off high-interest loans first, or avoiding unnecessary borrowing – helps keep liabilities down. These practices, you know, are the everyday actions that contribute to a stronger financial position for many families.

Even small, consistent efforts can add up over the years. The idea of compounding, where your savings earn returns that then earn their own returns, means that starting early and being consistent with financial planning can have a significant effect on a household's long-term net worth. So, while the overall "us net worth by percentile" picture is shaped by many large-scale factors, individual financial habits and decisions are also a very important piece of the puzzle, helping people move up those financial rankings over time. It is quite clear that personal choices matter a great deal.

The discussion of "us net worth by percentile" helps us get a clearer picture of financial standing across the United States. We talked about what net worth means, how percentiles offer a more accurate view than simple averages, and the different ways we can measure financial well-being. We also touched upon the broad distribution of wealth, the various factors that influence a household's financial position, and the role that personal financial planning plays in shaping individual outcomes. This comprehensive look helps to illustrate

Us Net Worth Percentiles 2024 - Kay Kalina

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

Us Net Worth Percentiles 2024 - Kay Kalina