The Medicare Donut Hole - What Happened To It?

For a good while, the phrase "the donut hole" probably brought a little bit of a worried frown to anyone thinking about their prescription medicine bills, especially if they were part of Medicare. This rather quirky name, you know, was a way folks talked about a period where your drug coverage seemed to just disappear for a bit. It was a real thing, a moment when you found yourself paying more for your needed medications, almost as if your usual help had taken a short break. It was a spot in your yearly spending where the financial support you relied on simply wasn't there in the same way, leaving you to pick up a larger portion of the tab for your prescriptions.

This particular coverage gap, often called "the donut hole," was a common part of Medicare Part D plans for a number of years. It was a temporary situation, to be sure, a kind of pause in the regular flow of how your medicine costs were handled. If you had one of these plans, and you needed a lot of prescriptions, there was a fair chance you would eventually come across this particular period. It was a point where the cost-sharing structure shifted, meaning you would temporarily shoulder a greater share of the financial burden for your daily or weekly medications, which, you know, could be quite a surprise for many.

But things have really changed, and for many people, this is a very welcome development. As we move into 2025, that well-known coverage gap, "the donut hole," is no longer a part of the Medicare landscape. This is a pretty big deal for many folks who depend on their prescription drug benefits. What was once a source of considerable worry for a lot of people, a moment when unexpected costs might pop up, has now been put to rest. So, if you've been wondering about this particular feature of your drug plan, it's actually a thing of the past, making the future a bit more predictable for medicine expenses.

Table of Contents

- What Was the Medicare Donut Hole, Exactly?

- How Did the Donut Hole Impact People?

- When Did the Donut Hole Begin to Change?

- The End of the Donut Hole - What Changed in 2025?

- Why Did the Donut Hole Exist?

- Looking Beyond the Donut Hole - What's Next for Drug Costs?

- A Final Thought on the Donut Hole's Departure

What Was the Medicare Donut Hole, Exactly?

The term "the donut hole" was, in a way, just a common, everyday expression people used to talk about a specific type of pause in how their prescription drug coverage worked within Medicare Part D. It was, you know, a period when the usual financial help for your medicines seemed to lessen quite a bit. This particular gap in coverage meant that after you and your drug plan had spent a certain amount of money on your prescriptions, you would then become responsible for a much larger share of the costs for a little while. It was, basically, a temporary limit on the help your plan would provide, and it could feel a bit like falling into an unexpected financial pit when it came to getting your necessary medications.

To put it simply, this "donut hole" was a part of the payment structure for Medicare Part D plans. It was, in some respects, a stage of coverage that came right after what was called the initial coverage period. During that first period, your plan would cover a good portion of your drug costs, and you would pay a smaller amount, like a copay or coinsurance. However, once the total spending on your prescriptions (including what your plan paid and what you paid) hit a certain dollar figure, you would then enter this gap. It was a point where, suddenly, you were responsible for a much higher percentage of your drug costs, which, you know, could make a real difference in your monthly budget.

So, you might be wondering, what did this mean for someone actually needing their medicines? Well, if you were enrolled in one of those optional Medicare Part D plans in 2024 or any year before that, there was a good chance you might have encountered this situation. It was a temporary spot in your yearly spending where your part of the bill for prescription drugs would go up quite a bit. This particular phase of coverage, the one folks informally called "the donut hole," was a period when you, the person taking the medication, had to make more direct payments for your prescription drug costs. It lay, you see, right between that initial period of coverage and what was known as catastrophic coverage, which came later.

How Did the Donut Hole Impact People?

The impact of "the donut hole" on individuals could be pretty significant, honestly. Imagine, for a moment, that you rely on several important medications every single day. For a while, your Medicare Part D plan helps out a lot with the cost, making your daily life a bit easier. Then, all of a sudden, you reach a certain spending amount, and the help from your plan changes dramatically. Your share of the cost for those very same medications jumps up, sometimes quite a lot. This could mean a sudden and unexpected increase in your monthly expenses, making it, you know, a bit of a challenge to keep up with your health needs.

For many, this period, this "donut hole," felt like a real financial strain. It wasn't just a minor adjustment; for some, it meant having to make tough choices. Perhaps they would have to delay getting a refill, or maybe even stretch out their doses, just to make their medicine last longer and try to avoid those higher out-of-pocket costs. It was a temporary limit on what your part of the plan would cover, and that temporary limit could feel like a very long time when you were facing bigger bills for essential medicines. This sort of unpredictability, you see, added a layer of stress to managing one's health, which, for many, was already a pretty serious concern.

The experience of entering "the donut hole" could be quite unsettling. One day, your copay is manageable, and the next, it's considerably higher. This sudden shift in payment responsibility meant that if you spent a certain amount on your prescription drugs through 2024, you would find yourself right in this coverage gap. It was a situation where the amount you had to pay out of your own pocket each month could really go up. This particular phase of coverage, which some people found very frustrating, represented a substantial change in how your drug costs were handled, leaving many feeling a bit exposed to higher bills for their ongoing health needs.

When Did the Donut Hole Begin to Change?

The structure of "the donut hole" didn't just disappear overnight; it actually started to change over time, bit by bit. There were efforts made, you know, to gradually close this gap in coverage, making it less of a burden for people. These changes were part of larger legislative actions aimed at making prescription drug costs more manageable for those on Medicare. It was a process, really, with different steps taken over several years to reduce the amount people had to pay when they found themselves in this particular part of their coverage. This gradual adjustment was a pretty important step in easing the financial pressure on many beneficiaries.

For a while, there were discounts offered on brand-name and generic drugs while someone was in "the donut hole." These discounts helped to lessen the financial sting, even though the gap itself still existed. So, while you were still technically in that coverage phase where you paid more, the amount you paid was reduced thanks to these efforts. It was a way of softening the impact, of making that temporary limit on coverage a little less harsh for people who needed their medications. This kind of ongoing work showed a clear movement towards eventually getting rid of the gap altogether, which, you know, was a goal for a lot of people.

The End of the Donut Hole - What Changed in 2025?

The biggest news regarding "the donut hole" is that, as of 2025, it's truly gone. This is a very significant development for everyone who relies on Medicare Part D for their prescription drug needs. The coverage gap phase of coverage, the one that used to be called "the donut hole," no longer exists as of December 31, 2024. This means that the period where you faced those higher out-of-pocket costs for your medicines is now officially a thing of the past. It's a change that brings a lot more predictability and, you know, a bit more peace of mind to managing drug expenses.

One of the key reasons for this important change is a provision from the Inflation Reduction Act of 2022. This particular piece of legislation included the elimination of the coverage gap, which, as we know, was informally known as "the donut hole." So, starting in 2025, Medicare Part D beneficiaries will continue to have their drug costs covered in a more consistent way. Instead of hitting that gap, the system has been updated to provide a different kind of protection for your spending. This is a pretty major shift, meaning you won't have to worry about that particular period of increased costs anymore.

What replaces "the donut hole" in 2025 is a new kind of spending protection. It's a new cap, actually, on how much you'll pay out of your own pocket for your prescriptions each year. Specifically, it's a limit of $2,000. This means that once your total out-of-pocket spending on covered prescription drugs reaches that amount in a calendar year, you won't have to pay anything more for your medicines for the rest of that year. This is a really big deal, offering a clear financial ceiling that wasn't there in the same way before. It provides a much clearer picture of your maximum yearly drug costs, which, you know, can help a lot with planning.

Why Did the Donut Hole Exist?

To understand why "the donut hole" was ever a part of Medicare Part D, it helps to look back at how the program was first put together. When Medicare Part D was created, it was designed with different phases of coverage. The idea, in a way, was to share the cost of prescription drugs between the individual, their drug plan, and the government. The coverage gap, or "donut hole," was originally built into this structure as a way to control costs and, perhaps, to encourage people to choose more affordable generic drugs or plans that offered better coverage in that particular phase. It was, basically, a design element of the program from its very beginning.

The thinking behind it, you know, was to create a tiered system of responsibility for drug costs. You had the initial coverage period where your plan paid most of the bill. Then came this middle ground, "the donut hole," where you paid a larger share. After that, if your spending was really high, you would enter what was called catastrophic coverage, where Medicare would step in and cover almost everything. This structure was, in some respects, a balancing act, trying to provide coverage while also managing the overall expenses of a large-scale drug benefit program. It was a way of structuring benefits that, for many, proved to be a bit complicated and, you know, financially challenging.

Looking Beyond the Donut Hole - What's Next for Drug Costs?

With "the donut hole" now a thing of the past, many people are, quite naturally, looking ahead to what comes next for prescription drug costs under Medicare Part D. The elimination of this gap is a very significant step, bringing more stability and predictability to how much people pay for their medications. The new $2,000 spending cap is a clear indication that there's a greater focus on protecting individuals from very high out-of-pocket costs. This change means that once you hit that yearly limit, your worries about drug expenses for the remainder of the year are, essentially, over.

This shift represents a move towards a simpler and, you know, more straightforward system for managing prescription drug expenses for those on Medicare. It aims to reduce the financial surprises that many people experienced when they unexpectedly found themselves in "the donut hole." The goal, it seems, is to make sure that people can get the medications they need without having to face sudden and very large bills. It's a change that, in a way, provides a much clearer financial path for beneficiaries, allowing them to better plan their budgets without the constant worry of hitting that unpredictable gap.

A Final Thought on the Donut Hole's Departure

The departure of "the donut hole" from Medicare Part D is, in many ways, a moment worth noting for millions of people. What was once a common source of confusion and financial stress for those relying on their prescription drug plans is now gone. For years, this temporary limit on coverage impacted how much people spent out of their own pockets each month, creating a period of increased consumer payments for necessary medications. It was, basically, a phase of coverage that came after an initial period of help, and it could make a real difference in a person's ability to afford their daily or weekly prescriptions.

As of 2025, this particular coverage gap, known informally as "the donut hole," has been replaced by a new system. This new approach includes a clear spending cap of $2,000, meaning that once you reach that amount in out-of-pocket costs, you won't pay anything more for your covered drugs for the rest of the year. This change, brought about by provisions in the Inflation Reduction Act of 2022, means that Medicare Part D beneficiaries will no longer face that unpredictable period of higher costs. It's a move towards greater financial security and a simpler path for managing prescription drug expenses for those who need it most.

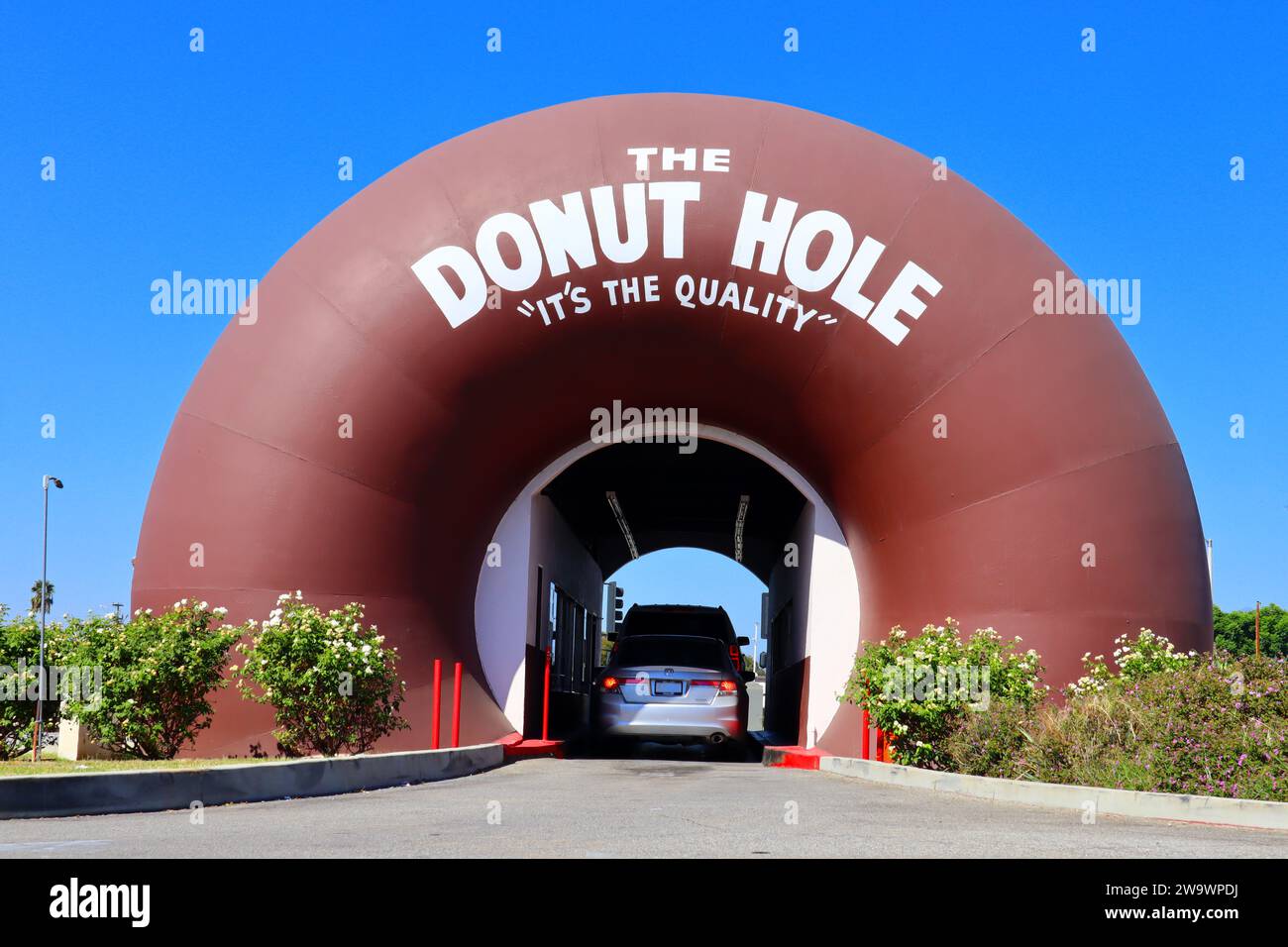

The Donut Hole | Discover Los Angeles

Giant Donuts of Los Angeles (and one Bagel) - Weird California

La Puente (Los Angeles), California: THE DONUT HOLE, Two giant Donuts