What's My Net Worth - Your Financial Picture

Have you ever, you know, paused for a moment to think about your money situation, that big overview of everything you possess compared to what you might owe? It's a pretty common thought, one that, honestly, crosses the minds of many folks trying to get a good grip on their finances. Figuring out this particular number can feel a bit like putting together a puzzle, but it truly offers a really clear look at where you stand financially, kind of like a snapshot in time. This bit of self-discovery, you know, is quite an eye-opener for many.

This idea, often called your personal net worth, is just a way to see how strong your money position truly is. It helps you understand if you're building up good things, like savings and investments, or if financial obligations are, in a way, holding you back from moving forward. Knowing this specific number, quite simply, shows the general well-being of your personal finances, which is, you know, pretty important for anyone looking to make smart choices with their money. It's a foundational piece of information, really, for charting a course for your financial future.

A lot of people, you know, ask themselves this very question, and it's a good one to bring up regularly. Getting this information doesn't have to be a hard thing to do, and there are helpful tools that can make it quite straightforward. We'll walk through exactly what it means and how you can easily get a firm grasp on your own financial standing, so you can, you know, feel more in charge of your money story. It's a step, you know, that brings a lot of clarity to your financial world.

Table of Contents

- What's My Net Worth - A Simple Explanation?

- Why Should I Care About What's My Net Worth?

- How Do I Figure Out What's My Net Worth?

- What's My Net Worth - Breaking Down Assets

- What's My Net Worth - Understanding Liabilities

- What's My Net Worth - Using a Calculator

- What's My Net Worth - The Benefit of Knowing

- What's My Net Worth - What Comes Next?

What's My Net Worth - A Simple Explanation?

When folks talk about "what's my net worth," they're really just talking about a straightforward calculation, you know, a very basic math problem for your money. It's what you have, everything you possess that holds some kind of value, with all the money you owe taken away. Imagine, for a moment, that you were to, you know, sell off all your belongings and then pay back every single debt you have. The amount of money that would be left over, or perhaps even the amount you'd still owe, is what your net worth is, you know, at that exact moment. It's a quick way to see your financial situation at a glance, kind of like a financial report card, in a way, showing your overall standing.

Everyone, and I mean everyone, has a number for their net worth. It could be a really large sum, it could be a modest figure, or it could even be below zero, which is, you know, totally okay and a starting point for many people. This figure isn't about how much money you bring in each year from your job or other sources, but rather about the total worth of your possessions once your financial obligations are accounted for. It's a pretty fundamental idea, actually, for anyone trying to get a handle on their money picture, and it's something that, you know, changes over time as you make different financial moves. It's a living number, you know, that tells a story.

The core of figuring out "what's my net worth" boils down to two main parts: what you own and what you owe. Think of it like a balance sheet for your personal finances. On one side, you list all the good stuff, the things that have value. On the other side, you list all the payments you still need to make. The difference between these two lists gives you that single number. It's a surprisingly clear way to sum up your financial life, which, you know, can be really helpful for making sense of it all. It simplifies a lot of complex money details into one digestible figure, which is, you know, pretty neat.

Why Should I Care About What's My Net Worth?

You might be thinking, "Why bother with what's my net worth?" Well, knowing this figure is, you know, really important for understanding your money health, honestly. It's like having a map for your financial path. Without it, you're just kind of moving along without a clear idea of where you are or where you might be headed. This number gives you a solid indication of how strong your money situation truly is, which, you know, helps you make better choices for the future, whether that's saving for a big purchase or planning for later life. It's a compass, in a way, for your financial direction.

For instance, if you want to become someone who has, you know, a good amount of wealth, knowing this number helps you see your progress over time. It lets you know where you stand today and what steps you might need to take to build up more financial value. It takes away the need for guesswork from your money plans, giving you a very clear picture of your financial standing, and that, you know, can be quite motivating. It shows you if your efforts are paying off, which, you know, is a really good feeling. It's a direct reflection of your financial journey, you know, up to this point.

Beyond just tracking progress, understanding "what's my net worth" also helps you identify potential areas for improvement. Maybe you discover that your liabilities are higher than you thought, or that your assets aren't growing as quickly as you'd like. This knowledge then allows you to adjust your spending, saving, or investment habits. It's a tool for self-correction, you know, giving you the power to steer your financial ship more effectively. It's about being informed, which, you know, makes all the difference in the long run. It provides a baseline, so to speak, for all your financial aspirations.

How Do I Figure Out What's My Net Worth?

So, you're ready to find out "what's my net worth," and you're wondering how to actually do it. The process is pretty simple, actually, quite direct. You just need to list everything you own that has a monetary value, which are your assets, and then list everything you owe to others, which are your liabilities. Once you have those two lists, you simply take the total value of what you own and subtract the total value of what you owe. The result is your net worth, in a way, your true financial position. It's a straightforward calculation that anyone can do, you know, with a little bit of effort.

This approach helps you get a clear and accurate number every single time you do it. It's a practical way to keep track of all your financial possessions and all your financial obligations in one place. Doing this regularly provides a clear picture of your financial standing, which, you know, is pretty helpful for keeping tabs on your money and seeing how things are changing. It's not as complicated as it might seem, honestly, and the payoff in terms of clarity is really worth it. You're basically creating a personal financial statement, which, you know, is pretty cool.

To start, you might want to gather all your financial statements. This includes bank statements, investment account summaries, loan documents, and credit card bills. Having these papers handy will make the process of listing your assets and liabilities much smoother. It's like collecting all the pieces of a puzzle before you start putting them together. This step, you

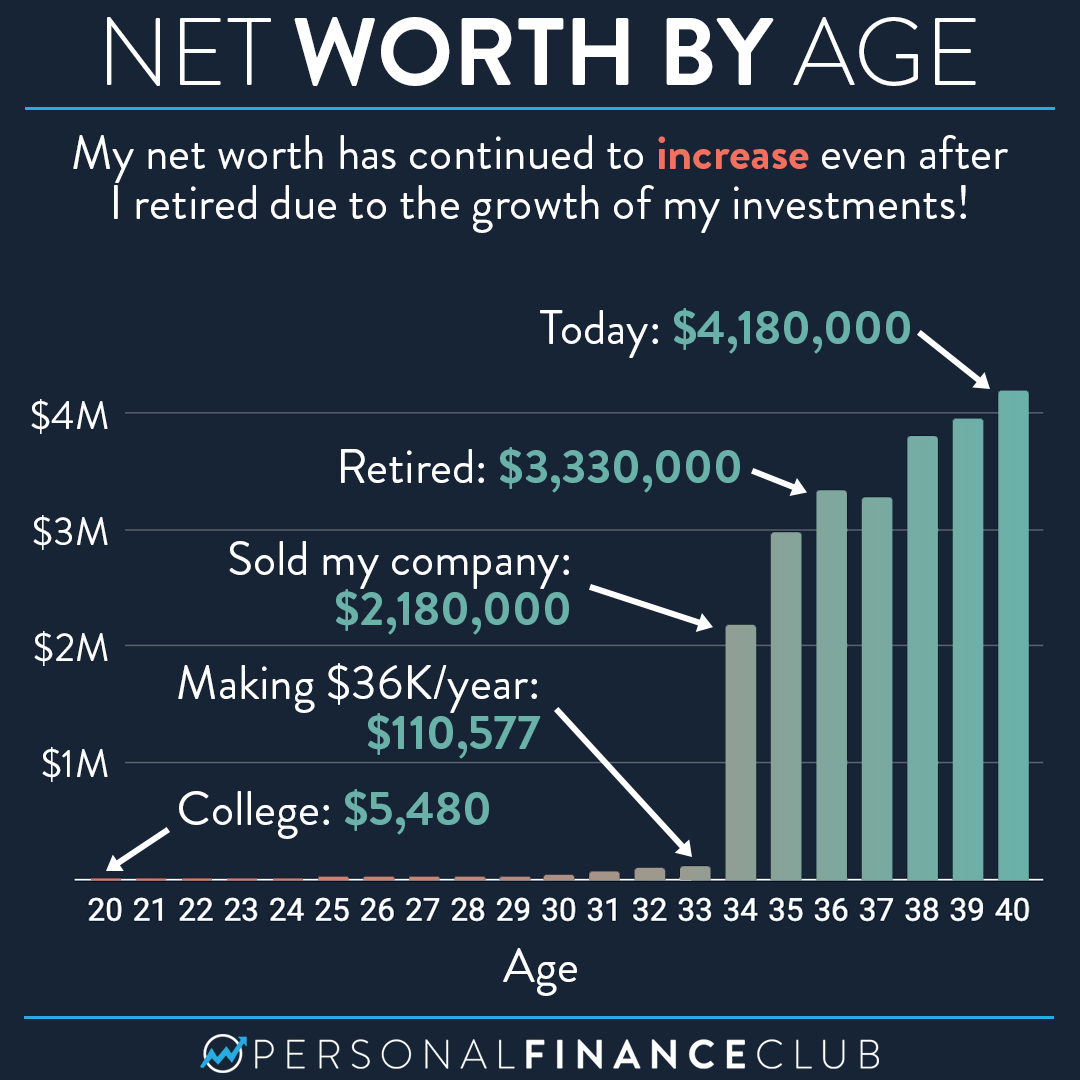

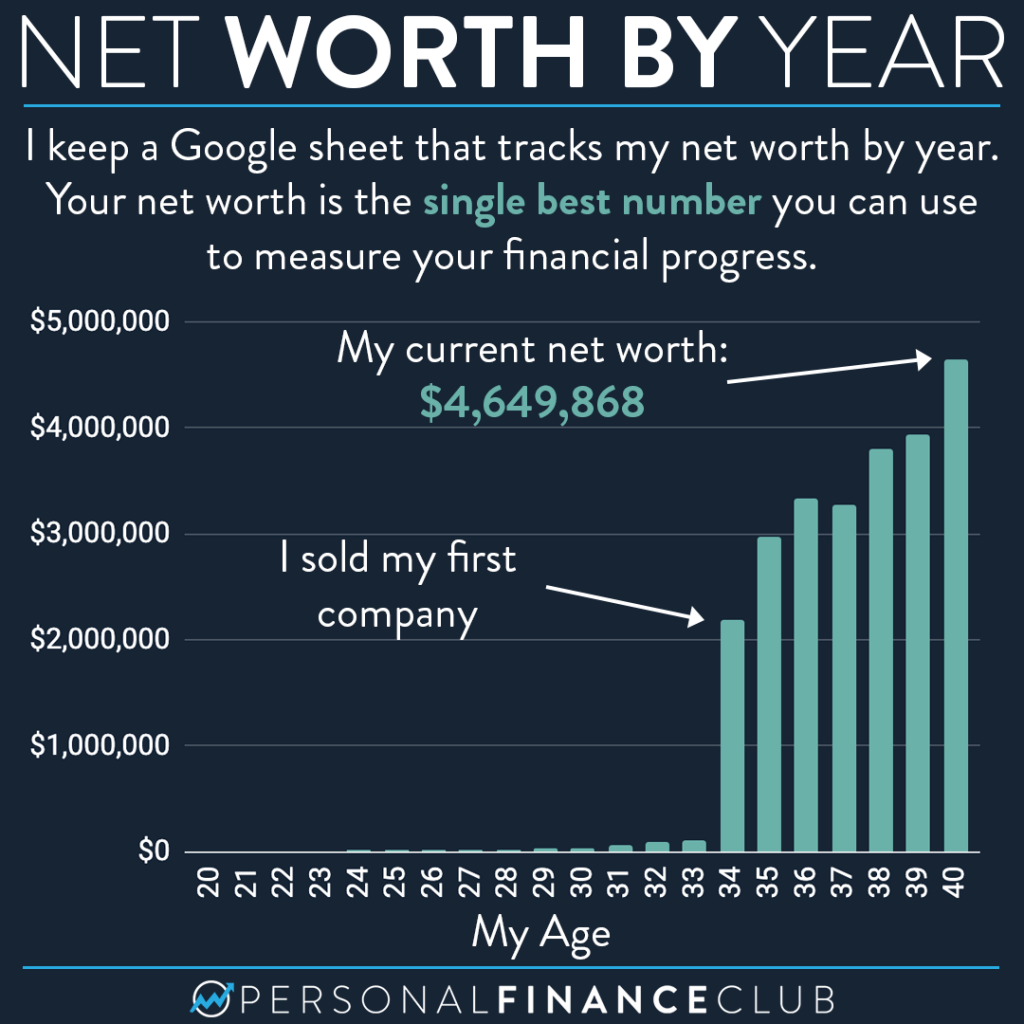

Here’s how my net worth has changed in the last 20 years – Personal

/what-is-your-net-worth-be7a33afb9da4529abd5e376b5d325c2-f0ca49fbebe14c65a0214ae612dee924.png)

How To Calculate Your Net Worth

My net worth throughout the years – Personal Finance Club